We may be approaching the end of the

year, but there’s still much to dissect and discuss in the IT channel.

As always, your top source of regular market insight is CONTEXT’s

weekly webinar briefings—where our expert analysts from across the

globe share key data and trends to help improve your data-driven

decision-making. Among our highlights this month are falling reseller

counts, AI growth, and distributor strength in the PC market.

Here's our pick of the top stories

in more detail:

Reseller count drops 7% annually

in France in October

CONTEXT’s ChannelWatch report is

compiled from the largest IT reseller survey in Europe, delivering

invaluable insight into the health of the sector. It revealed a 6.8%

year-on-year (YoY) decline in reseller numbers in France in October,

and declines across the board in the UK, Italy and Spain. The falling

count for small and medium resellers (SMRs) was particularly sharp as

more firms consolidated.

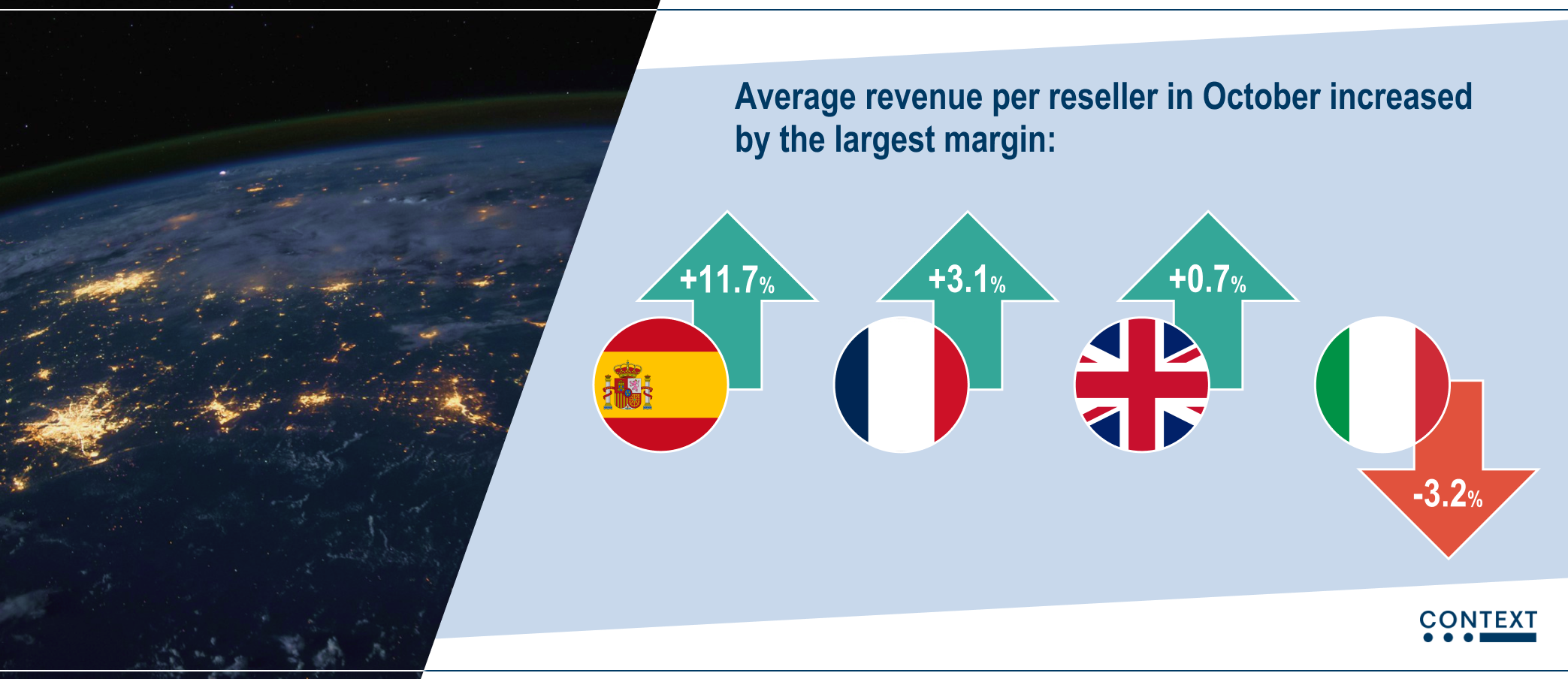

Aside from in Italy, average

revenue per reseller increased in the period, suggesting that

remaining businesses are becoming more productive or focusing on

higher value products. Average revenue per reseller in October

increased by the largest margin in Spain (11.7% YoY), followed by

France (3.1%) and the UK (0.7%). In Italy, the figure declined by

-3.2% YoY.

Distributors are the clear

route-to-market winner in PCs

CONTEXT’s Routes to Market (RTM) is

a relatively new analytics report designed to help readers

understand the strength of distribution compared to other channels.

It revealed that, in October, distributors were the clear winners in

terms of PC sales, accounting for 47% of products bought by end

users. This is the culmination of a steady increase in RTM share

since March. While encouraging, we normally expect more

non-distribution sales in November and December. There were also

regional differences. In Italy, around 60% of products were sold by

distributors in October, while in France, non-distribution

dominated. In Germany and the UK, they were neck and neck.

Spanish resellers commit to AI spending

According to our ChannelWatch

report earlier this year, 45% of Spanish resellers say they’ve

started working with partners on AI concepts, including software

(49%), PCs (14%), servers (20%). Additionally, over half (56%)

consider the technology to be “very important”, “very significant”

or “significant” to their business strategy. Chatbots, machine

learning and predictive analytics are particularly favoured. Yet

just 14% are “somewhat ready” or “very ready” to integrate AI into

existing systems, highlighting significant opportunities for future

growth. That comes as revenue growth has slumped -2.9% YoY year to

date (YTD) in the country, despite positive growth returning in Q3.

Germany drives AI-capable

notebooks to 31% market share

Germany is leading a surge in

AI-capable notebook sales—i.e. notebooks based on chipsets with neural

processing units (NPUs). In Week 43, CONTEXT recorded the market share

of such machines at 31%, while in Germany it reached 48%. This growth

was observed across most of the top OEMs, particularly in the

commercial segment, rather than being driven by a one-off project or

sale. Although less pronounced, we see the same trends happening

across Europe. Copilot + PCs accounted for around 5% of AI-capable

notebooks in Week 43, with most (77%) of these based on Qualcomm

Snapdragon chips, while Intel Core Ultra Series 2 accounted for 15%,

and AMD Ryzen AI 300 was on 8%.

Stay up to date

on the latest market intelligence for the IT channel,

by tuning into CONTEXT’s weekly IT Industry Forum

webinars.