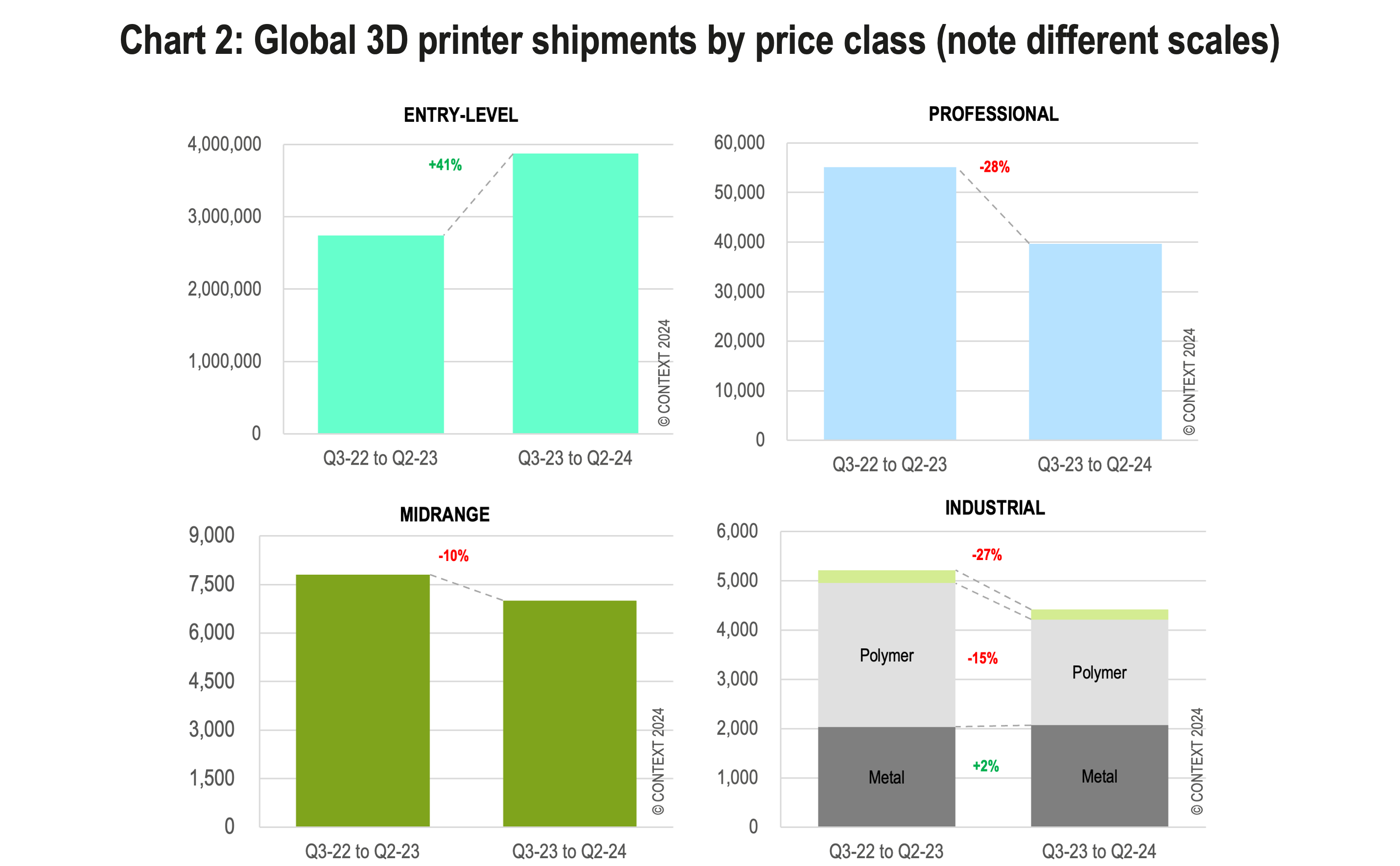

London, 15 October 2024 – Second–quarter results for

global 3D printer system shipments mirrored the trend from Q1, with

year–on–year (YoY) declines in the INDUSTRIAL, MIDRANGE, and

PROFESSIONAL price segments, while ENTRY–LEVEL devices continued their

explosive growth, according to latest insights by global market

intelligence firm CONTEXT.

The INDUSTRIAL sector continued to struggle with

weak global shipments of polymer systems, particularly polymer vat

photopolymerization systems. As in Q1 2024, metal systems performed

better, with China’s domestic metal powder bed fusion (PBF) shipments

standing out as a bright spot, growing 7% year–on–year.

The latest insights into global 3D printer system

shipments highlight very different trends at the high–end and the

low–ends of the hardware market. The slow–down in new equipment

shipments in the all–important INDUSTRIAL segment has allowed

companies which focus in that space – particularly Western companies –

to take a step back to look at their own financial health with many

then moving forward with long–coming consolidation. Conversely, the

continued acceleration of the consumer–centric ENTRY–LEVEL has allowed

companies which focus on this segment to thrive in the moment.

Three key developments marked Q2 2024:

- The INDUSTRIAL segment saw a deeper decline, with

shipments dropping –25% year–on–year, marking the fourth

consecutive quarter of decline.

- The PROFESSIONAL

segment showed improvement, largely driven by a successful new

product launch from Formlabs.

- The ENTRY–LEVEL price

class experienced even more robust growth, with shipments

soaring 65%.

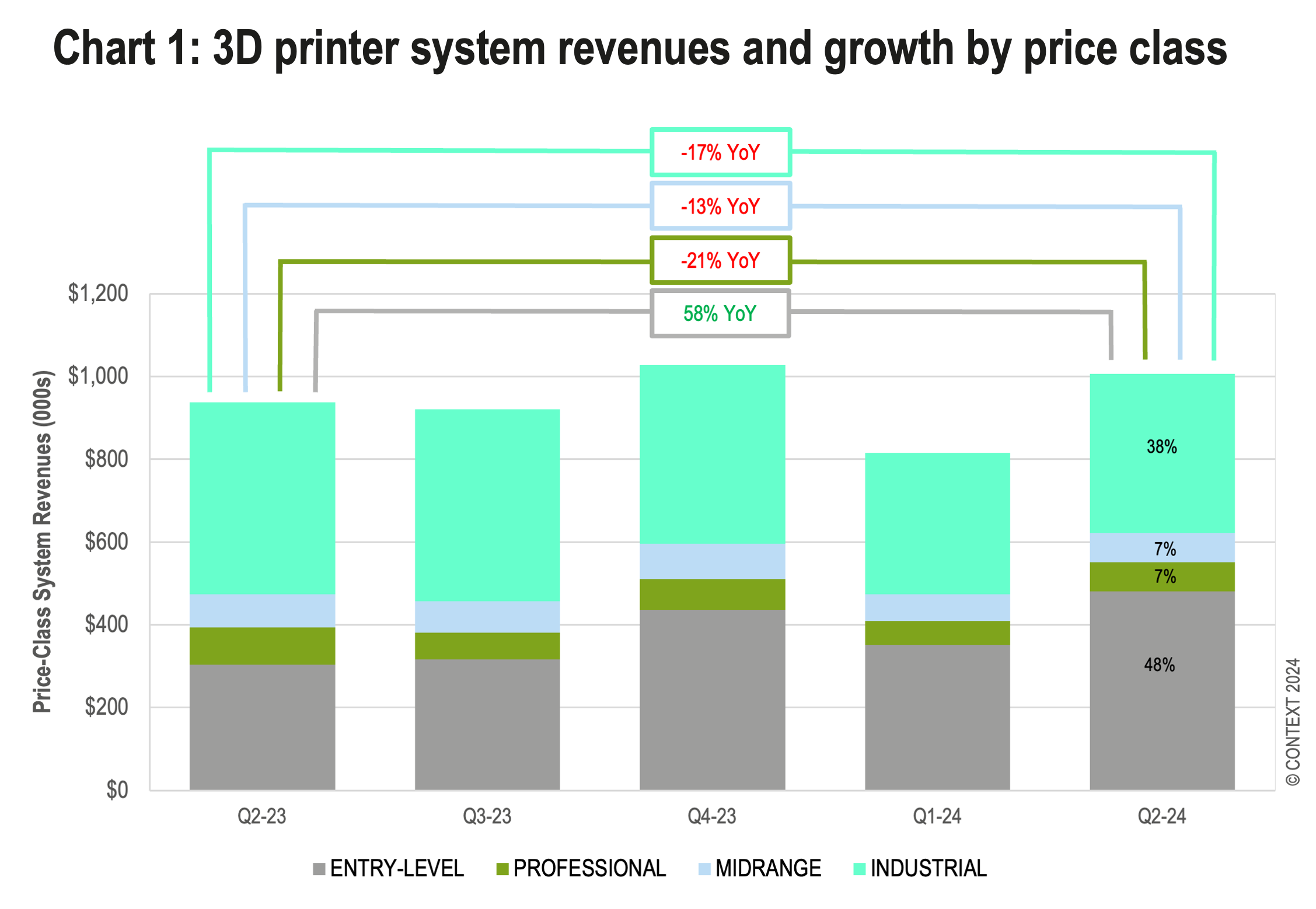

The 7% year–on–year increase in global 3D printer

revenues for the quarter was driven entirely by the surge in

ENTRY–LEVEL shipments, with revenues 58% higher than in Q2 2023.

Revenues in all other segments declined compared to the previous year,

with the sharpest drop in the PROFESSIONAL segment (down –21%), though

the –17% decline in INDUSTRIAL printer revenues is the most

concerning. ENTRY–LEVEL printers accounted for 48% of global system

revenues during the quarter, surpassing INDUSTRIAL systems (38%) to

become the top–grossing price class.

INDUSTRIAL POLYMER SYSTEMS

The biggest challenge in this $100,000+ category,

where total shipments dropped –36% YoY, again came from low levels of

vat photopolymerisation shipments. These were down –47% in aggregate

with weak shipments both from Chinese vendors (market leader UnionTech

saw a notable YoY decline) as well as from Western Original Equipment

Manufacturers (OEMs). In particular, 3D Systems continues to struggle

as its top customer has been stymied by weak downstream demand as

inflation has shifted consumer spending away from cosmetic dental

procedures. UnionTech remained dominant in the global INDUSTRIAL vat

photopolymerization market, with 3D Systems leading in the West.

INDUSTRIAL METAL SYSTEMS

In Q2–24, –7% fewer INDUSTRIAL metal printing

systems were shipped across the globe than in the year before

although, on a trailing–twelve–month (TTM) basis, shipments were up

marginally (by 2%).

Powder Bed Fusion (PBF) remained the most popular

technology, accounting for 78% of metals units shipped and 85% of

metals revenues. This modality also represented the best–performing

category as shipments were essentially flat YoY (down only –1%) and

completely flat on a TTM basis. Nonetheless, a few OEMs, all from

China, saw exceptional shipment growth (31% for BLT, 29% for Eplus3D

and 54% for ZRapid Tech). In fact, Chinese vendors (mostly selling

domestically) accounted for 53% of all INDUSTRIAL metal PBF systems

shipped in the period but for only 32% of revenues. However, growth in

this region appears to be decelerating: just 5% more printers were

shipped from China in Q2–24 than in Q2–23 (compare this with 19%, 38%

and 45% YoY growth in the previous three quarters). BLT was the global

leader in INDUSTRIAL metal PBF system shipments with EOS again

enjoying the top spot in terms of revenues.

Western vendors saw YoY shipments of INDUSTRIAL

metal PBF machines improve slightly but they were still –2% down YoY.

There were improvements for some vendors – notably TRUMPF (shipments

up 22%) and Colibrium/GE Aerospace (35%) – while others experienced a

more challenging quarter. Nikon SLM Solutions shipped fewer printers

in the period but saw very strong YoY revenue growth (over 30%) as

end–market attention has largely shifted to their NXG systems and

shipments of these ultra–advanced systems continue to accelerate. Many

other vendors have introduced high–efficiency (large build volume and

high laser count) metal PBF systems in recent quarters, but only Nikon

SLM Solutions is shipping them in volume.

MIDRANGE SYSTEMS

MIDRANGE ($20,000–$100,000) 3D printer sales were

again down in Q2–24 with –6% fewer products shipped globally in Q2–24

than in the same period of the previous year. In this near–term

quarter, all modalities except vat photopolymerization were down. On a

TTM basis, all processes were down with –10% fewer products shipped

collectively in the category from Q3–23 to Q2–24 than from Q3–22 to

Q2–23. The previously accelerating polymer PBF market – mostly driven

by Formlabs in this price class – seems to have settled into a run

rate. Most of the vendors doing well in this space at the moment are

from China mainly selling domestically. Q2 shipments from Chinese

vendors were up 18% YoY while those from all others across the globe

were down –15%. All Western vendors in the top 10 saw shipments fall

while the opposite was true for the three Chinese vendors – UnionTech,

ZRapid Tech and Flashforge. UnionTech shipments were 12% higher than

in Q2–23 and Flashforge shipments rose a whopping 90%. Stratasys,

UnionTech and Formlabs were again the top 3 global vendors in the category.

PROFESSIONAL SYSTEMS

After several quarters of sizable YoY shipment

declines, shipments of printers in the PROFESSIONAL price class

($2,500–$20,000) were down only –10% YoY in Q2–24. This was mostly

thanks to a strong product transition by Formlabs. On a TTM basis,

shipments were still down significantly (–28%) with much of the demand

shifting to lower priced ENTRY–LEVEL products. UltiMaker and Formlabs

remained the top global vendors in this price class with UltiMaker

focused on material extrusion devices and Formlabs on vat

photopolymerisation products. This segment has historically favoured

FDM/FFF solutions with material extrusion shipments typically

outpacing vat photopolymerisation 65/35. This has changed over the

last year or so and the shipment rate was closer to 50/50 in the

second quarter of 2024. Shipments of material extrusion printers were

down –21% YoY but those of vat photopolymerisation products were up 6%.

ENTRY–LEVEL SYSTEMS

The low–end ENTRY–LEVEL category (<$2,500)

excelled again in Q2–24 with shipments up 34% sequentially, 65% YoY

and 41% on a TTM basis. Creality continued to crush the competition

with shipments up 64% YoY (and 45% for the full half year) accounting

for 47% of all printers shipped in the price class during the quarter.

Their growth rate was only bettered by Bambu Lab which again

registered triple–digit YoY shipment growth (up 336%) giving them 26%

of the global share. A total of 94% of shipments in this sub–$2,500

category were from the top 4 vendors – Creality, Bambu Lab, Anycubic

and Elegoo.

OUTLOOK

The second quarter of 2024 was difficult for many

Western companies – Stratasys, Velo3D and Markforged all announced

layoffs and others filed for bankruptcy. Long–expected major

consolidations in the region accelerated as Nano Dimension announced

acquisition plans for both Desktop Metal and Markforged. Even though

high interest rates continued to delay new CapEx spending, most OEMs

reported high levels of interest and engagement, however.

This suggests that INDUSTRIAL 3D printer

purchases are poised to see strong shipments once the cost of money

comes down, much in the same way that markets opened up immediately

post Covid. The aggressive half–point interest rate cut the US

Federal Reserve announced in September (its first cut in four years)

was welcome news for many in the industry who see it as a great

start and anticipate three to four such cuts by H2–25 that will

allow businesses to begin to significantly improve.

Based on this outlook, 2024 forecasts for the

crucial INDUSTRIAL price class have been downgraded, with recovery now

anticipated in the latter half of next year, according to CONTEXT.

Despite this, marginal growth is still expected in 2024, with unit

shipments projected to rise by 1% year–on–year and revenues by 6%,

driven primarily by domestic demand for metal PBF systems in China.

Short–term forecasts for the MIDRANGE and PROFESSIONAL segments have

also been lowered, with fewer printers expected to ship in 2024 than

in 2023. However, high single–digit to low double–digit growth is

predicted for 2025.

While China struggles with weaker than expected

GDP growth, Chinese vendors continue to do well both domestically

(in the metal PBF systems INDUSTRIAL category) and overseas (as

almost all ENTRY–LEVEL vendors are Chinese). Several Chinese OEMs

(some focused on the INDUSTRIAL sector and some on the ENTRY–LEVEL)

are set to go public and there is some concern that recent shipment

growth is the result of market pushes of product ahead of their

flotation. However, there is no regional or channel inventory

build–up and this suggests that all current demand is real demand.

Over the longer term, the INDUSTRIAL segment is

expected to grow the most – with a five–year forecast CAGR of 19% – as

the cost of capital lowers and as additive manufacturing is more and

more leveraged for volume serial production.