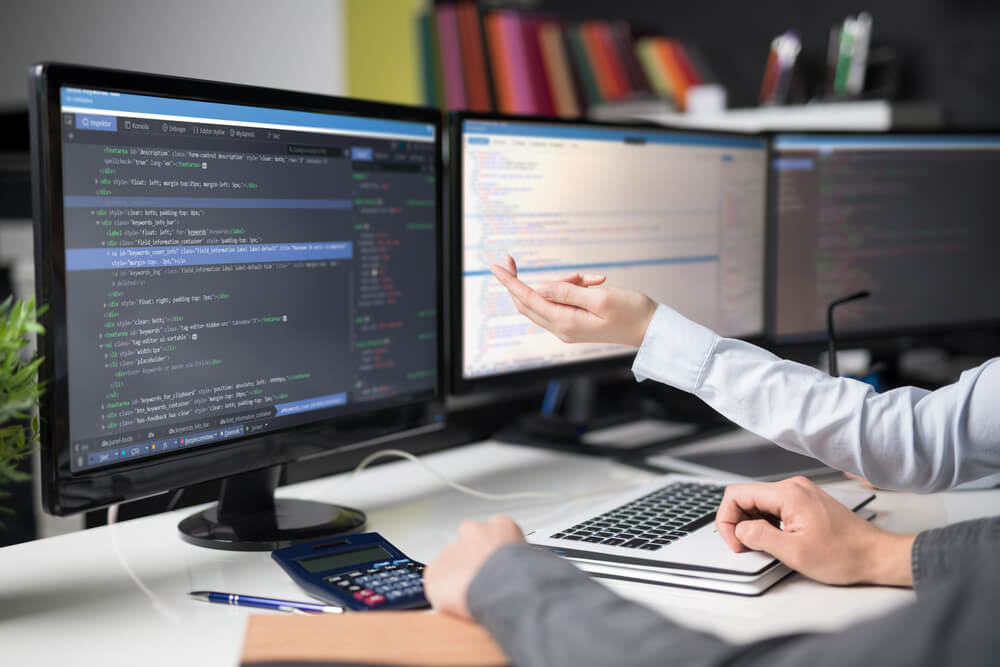

Even as the monitor market matures in step with the desktop PC market, the growth of niche segments is providing opportunities for increased sales and margins.

Global consumer-monitor shipment ASPs continue to rise, driven by the product-mix shift towards higher-specification models, such as gaming monitors, that come with an ASP premium and are distinguished by a number of key attributes, including high resolution, HDR capabilities, ultra-wide format, and high refresh rates.

Business-targeted monitors, meanwhile, have higher ASPs than consumer monitors and are the main volume/revenue drivers. As companies invest in modernising the workspace with flexible display solutions, a number of premium features are on the rise - including multi-HDMI ports, DisplayPort and USB-type C inputs, ultra-wide formats, and ergonomic flexibility.

Whether vendors are focusing on the mature, but still substantial, business-monitor space, or on niche segments such as PC-gaming monitors, they need granular, attribute-level sell-in and sell-through market data to guide their strategic positioning.

-

Ultra-Wide

Ultra-Wide -

Medical

Medical -

Graphics

Graphics -

Gaming

Gaming -

Curved

Curved

Services & Solutions

-

Market Intelligence

Track units, sales, revenues and pricing at all stages of the supply chain

- More

-

Business Analytics

Set targets, take action and measure results with KPIs covering all the drivers of your marketing mix

- More

-

Additional custom reports

Data Intelligence Service - Gain a consolidated view of the latest market dynamics

Global ShipmentsPlus - Track consumer and commercial desktop monitor shipments - split by 135 individual countries and over 25 specifications