London, 17 April 2024 – The fourth quarter of 2023

was a difficult period for many systems’ manufacturers across the

global 3D printer landscape with printer shipments across three of the

four main price–classes falling from a year ago, according to the

latest market intelligence from CONTEXT.

Traditionally, around 30% of all 3D printers

sold each year are shipped in the fourth quarter. This trend was

bucked in Q4 2023 against a global landscape marked but shifting

buying patterns, sticky inflation and the high–cost of capital.

While there was a small (1%) quarter–on–quarter

(QoQ) increase for global Industrial price–class ($100K+) printer

shipments in Q4– 23, volumes were down –13% from Q4–22 as high

interest rates across the globe led to businesses waiting for the rate

decreases before investing in new capital equipment. Struggling with

similar issues seen from Industrial printers, Midrange ($20–$100K)

printer shipments were down –7% year–on–year (YoY.) Shipments of

Professional ($2.5–$20K) models dropped by –32% as companies impacted

by “sticky” inflation sought out cheaper alternatives. This had a

positive effect on sales of Entry–level printers costing less than

$2,500 – however, with shipments of these products up 35% YoY.

In spite of inconsistent regional economic

growth and recovery, many aspects of key economies around the globe

remain positive. We’re seeing strong GDP growth projections for

China and stronger than expected GDP growth and high stock market

levels in the US for example. All indications are that demand has

simply shifted out.

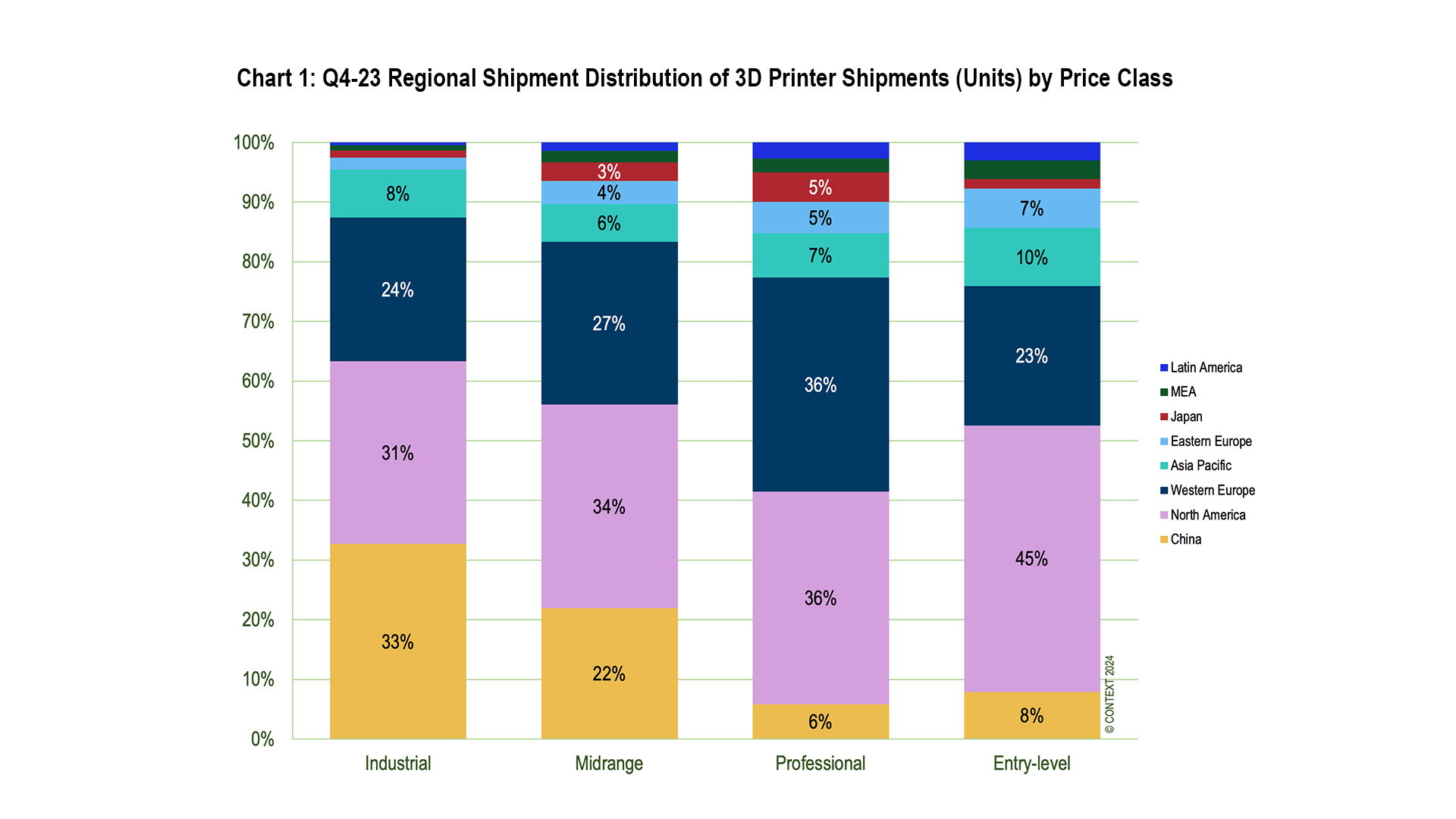

In aggregate across all price–classes, North

America is still the biggest market for 3D printers with shipments to

this region generating 41% of all systems’ revenues in Q4 2023. For

comparison, shipments into Western Europe were responsible for 26% of

revenues and those in China for 18%. Of these three leading regions,

the market in China has seen the most growth recently and it remains

the top market for the all–important Industrial price–class. From a

unit shipment perspective, 33% of the global shipment total for

Industrial price–class printers in the period were shipped into

domestic China. China’s dominance in the metals space is even more

impressive with 43% of the global shipment total of Industrial Metal

3D Printers shipped in the last quarter shipped there. Most of this

huge demand is met by domestic suppliers.

INDUSTRIAL SYSTEMS

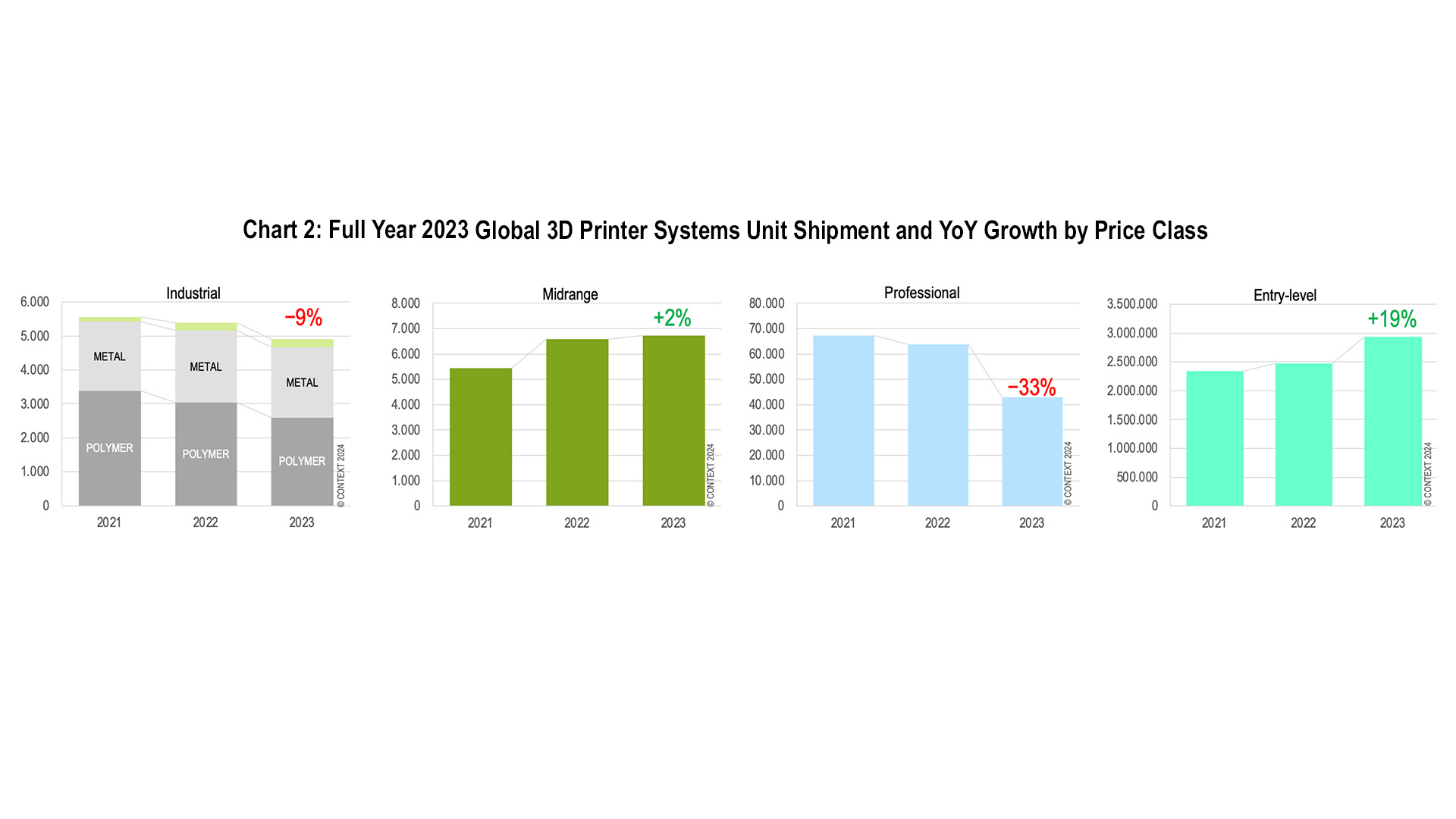

This price category remains key, accounting for

just over 50% of all systems’ revenues in 2023. The fourth quarter saw

global Industrial shipments drop –13% YoY largely due to a –25% drop

in polymer systems with particular weakness in the polymer vat

photopolymerization space. UnionTech (in China) and 3D Systems

(predominantly in the West) both experienced falls in sales of vat

photopolymerisation machines. Shipments of Industrial metals printers

were actually up 4% because of growth of the powder bed fusion (PBF)

market in China and increasing sales of directed energy deposition

(DED) systems worldwide. For the full year, this price–class has been

severely impacted by reductions in capital expenditures (due to high

interest rates), resulting in aggregate shipments of Industrial

systems dropping –9% from 2022.

INDUSTRIAL METAL SYSTEMS

Although shipments of Directed Energy Deposition

(DED) systems grew by 30% YoY in Q4 2023, Powder Bed Fusion (PBF) was

still the most common metal technology in class, representing 72% of

all Industrial metal additive manufacturing (AM) machines shipped in

Q4–23. An overall fall of –1% in shipments of PBF systems in Q4 masks

the detail that while unit shipments were down in North America and

Europe, shipments were up YoY in China.

Chinese vendors had a weak Q3 last year but

bounced back in Q4, shipping 25% more PBF printers that a year ago

(mostly to their home region). Indeed, the four top shippers of

metal PBF printers in the period – BLT, Farsoon, Eplus3D and HBD –

were all Chinese and three of these saw YoY increases: 3% for BLT,

23% for Farsoon and a sizable YoY shipment jump of 100%+ for

Eplus3D. Over half (52%) of all Industrial metal PBF printers

dispatched worldwide now come from vendors based in China. Western

vendors in the space saw unit shipments drop –20% from Q4–22. For

the full year, Industrial Metal system shipments dropped –3% as

fewer Metal Powder Bed fusion systems shipped globally in 2023 than

in 2022. Other metal modalities, including Directed Energy

Deposition (DED) and Binder Jetting saw healthy or moderate growth

(up 15% and 2% respectively.)

INDUSTRIAL POLYMER SYSTEMS

Vat photopolymerisation shipments fell by –39%

YoY in Q4 2023 as the two leading companies both faced challenges.

Shanghai’s UnionTech, which has a 49% share of

this category, principally sells into mainland China and is still

seeing an uneven recovery from Covid lockdowns in H1 2022 that have

left shipments fluctuating unevenly from quarter to quarter.

The Western leader in the category – 3D Systems

– continued to be challenged by weak demand from dentistry, its key

end–market for this technology. Economic pressures have shifted

consumer spending away from cosmetic dental procedures so few

companies in the sector are investing in new machines.

MIDRANGE SYSTEMS

In Q4 2023, unit shipments of Midrange systems

were up 16% sequentially but fell –7% on the previous year. The

category was a bit of mixed bag with shipments from half the vendors

falling YoY while the those from the other half were flat or

increasing. Among those who had a successful quarter were:

UnionTech, whose domestic Vat Photopolymerization shipments were

strong throughout the year and continued to grow; Flashforge, who

saw increased demand for their WaxJet printer; and Nexa3D, which

benefitted from the Polymer Powder Bed Fusion business it acquired

from XYZprinting.

Over the year as a whole, the category leaders

were Stratasys (once again), UnionTech and Formlabs. UnionTech and

Formlabs led growth in the category. While these two vendors enjoyed

impressive yearly growth in the category (of 88% and 123%

respectively) the overall segment only saw a marginal YoY growth of

2%. Stalwarts Stratasys, 3D Systems and Markforged all saw a

double-digit percentage drop in unit shipments of Midrange machines

in 2023. Key drivers in 2023 were Formlabs, who successfully created

a market for new low–end polymer PBF models, and UnionTech which

focused their attentions on the growing China market.

PROFESSIONAL SYSTEMS

The last quarter of 2023 was another difficult

one for products in this price–class. While shipments of

Professional 3D printers were 21% higher than in Q3, they were down

YoY for a ninth consecutive quarter. Share shifts in this period of

globally high inflation have not been so much within the price–class

as between this class and the one below. Professional buyers have

recognised that Entry– level products, once perceived as being for

only for consumers, offer similar functionality to models in this category.

Shipments over the full year dropped

precipitously, falling by –33% YoY. Every vendor in the global top

10 – with the exception of start–up Nexa3D – shipped fewer printers

in 2023 than in 2022. Over recent years, manufacturers of

Professional printers have been able to maintain or increase

revenues even as unit sales have fallen by offering new features and

raising prices. This strategy proved to be less effective in 2023 as

inflation changed end–market purchasing habits however. Key vendors

historically focused on this price–class, including UltiMaker,

Formlabs and Raise3D, are now poised for product expansions and are

aiming to reverse market trends in the coming year.

ENTRY-LEVEL SYSTEMS

Nearly a million (993K) Entry–level 3D printers

were shipped worldwide in Q4 2023 – a new quarterly record! Although

Creality’s shipment increase in the quarter of 38% YoY was impressive,

Bambu Lab’s 3000% growth stands out and was one of the main

contributing factors to the performance of the category overall. If

these two vendors are excluded from the data, shipment growth in this

price–class was only 2%. While some companies, such as Flashforge,

also experienced nice levels of growth (36%), others saw shipments

drop (by –51% in the case of Toybox, for example).

For the full year, shipments rose 19% from 2022

with global inflation ironically expanding the market base for this

type of printer. 94% of Entry–level printers shipped in 2023 came from

Chinese vendors (up from 88% in 2019) and 89% came from just four

vendors: Creality, Anycubic, Elegoo and Bambu Lab.

OUTLOOK

As Q1 2024 came to a close, many forecasts for

2024 remained conservative. While we expect the projections of

Industrial–focused players in particular to remain cautious as they

wait to see how interest rates change across the globe, many see

strong signs of pent–up demand. GE Additive – part of the newly

separated GE Aerospace – has earmarked a good portion of its announced

$650M 2024 spend for additive. Other US companies have reported

increased demand from defence customers thanks to new federal

government investment. In China, UnionTech has announced plans to

further expand their product portfolio in 2024 on top of their recent

expansion from polymers into metals.

Forecasts for total worldwide shipments in 2024

predict single–digit percentage unit growth in all price–classes

(Industrial 5%, Midrange 4%, Professional 3%, Entry–level 8%), rising

to double–digit percentage growth by 2025 (2024 to 2025 forecasts are

Industrial 16%, Midrange 12%, Professional 13%, Entry–level 11%).

However, the hope is that the pent–up demand seen on the horizon can

be pulled–into 2024.

* Price–class groups: Industrial $100,000+;

Midrange $20,000–$100,000; Professional $2,500–$20,000; Entry–level

<$2,500 (combines former Personal and Kit&Hobby classes).