April was another interesting month in the European

IT channel. And once again, CONTEXT was on hand every week to run

through the key trends for our industry partners. This past month, of

note were new Q1 2024 figures for the cybersecurity and UPS

categories, and the Nordics, as well as a fresh look at the

astonishing AI–powered growth of tech stocks.

Here are some of those highlights in more detail:

The tech stock market powers on:

At the beginning of April we took a look at the

performance of tech stocks on some of the world’s biggest bourses. The

past six months have witnessed astonishing growth, driven by rising

expectations about AI. To put it in perspective, we recorded 228%

growth between September 2019 and October 2023 in the Semiconductor

industry. Since then there has been a surge in the value of

semiconductor stocks, which are now valued at 457% of their September

2019 value. AMD at 470% and NVIDIA at 1869% are the key contributors

to this change. The same phenomenon can be seen in Personal Systems

stocks which have all grown significantly in the last 6 months led by

Dell Technologies: and Infrastructure led by VMWare, Vertiv, Fortinet

and Palo Alto (to name a few).

UK & Ireland grows strongly in cyber as MSPs soar:

It’s been a tough few weeks for UK & Ireland

distributors, but in cybersecurity there was better news in April. Our

analysis of Q1 2024 found that although the cybersecurity market as a

whole declined –5.9% year–on–year (YoY) in revenue sales, in the UK it

surged by around 5% YoY. France (11% YoY) appeared to do even better.

Much of this growth has been driven by the success of managed service

providers (MSPs) which saw a 10.6% YoY increase in revenue – rising

even higher in the UK (30%) and Italy (18%). MSPs are increasingly

important part of the cybersecurity market, helping SMBs to enhance

their cyber–resilience amidst major industry skills shortages.

Software the lone bright spot for the Nordics:

In Scandinavia, interest rates remain high even

though inflation is coming down quite nicely in most countries. This

is feeding into private sector project delays and a corresponding hit

to the corporate reseller channel. As per Europe as a whole, it is

software and services that’s driving growth. In fact, the category

grew revenue 9% YoY in Q1 2024, versus 0% in Europe. Stripping out

services, software alone grew by more like 15% during the period.

Altogether, the Nordics region posted YoY revenue growth of –5.2% in

Q1 2024, which is a bit lower than hoped given favourable comparatives

a year ago.

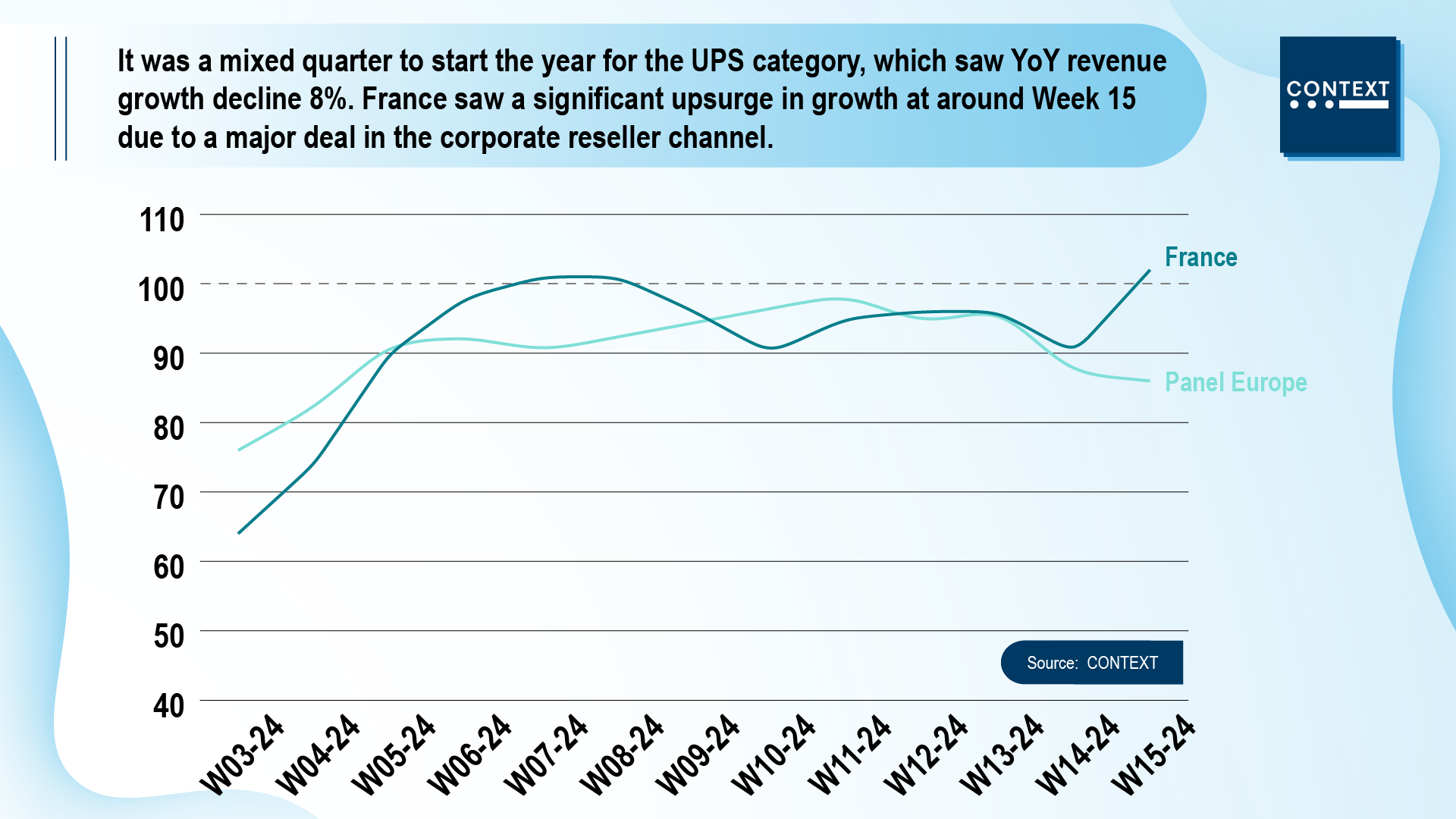

UK, France and Germany drag down UPS revenues

It was a mixed quarter to start the year for the

UPS category, which saw YoY revenue growth decline 8%. That’s mainly

due to poor performance in Germany, the UK and France, despite

positive growth in Poland and the rest of Europe, led by the

Netherlands. France saw a significant upsurge in growth at around Week

15 due to a major deal in the corporate reseller channel, equivalent

to six or seven times normal weekly throughput there. Retail activity

in Germany has been strong in recent weeks, which bodes well for the

category given the size of this channel.

Part of the value clients get from the CONTEXT

database is its ability to pick out trends in a highly granular

manner. Thus, we can look at the data at a specification level, to see

that the capacity band performing best in Q1 was 5,000–10,000 kVA. And

by product line – which is the safest and most expensive form of UPS –

we can see that online performed better than line interactive and offline.

To find out more, register to tune into our

30–minute weekly IT Industry Forum

webinar here.