As we approach the fourth quarter, we are refining

our forecast for the second half of the year. In CONTEXT’s weekly

webinar briefings, we share key data and trends to support data–driven

decision–making, tracking European distribution sales results week by

week. Among this month’s highlights are the latest growth predictions

for 2024, an improving outlook for South Africa, a rebound in German

consumable sales, and the emergence of new AI chips.

Here’s a closer look at our top stories:

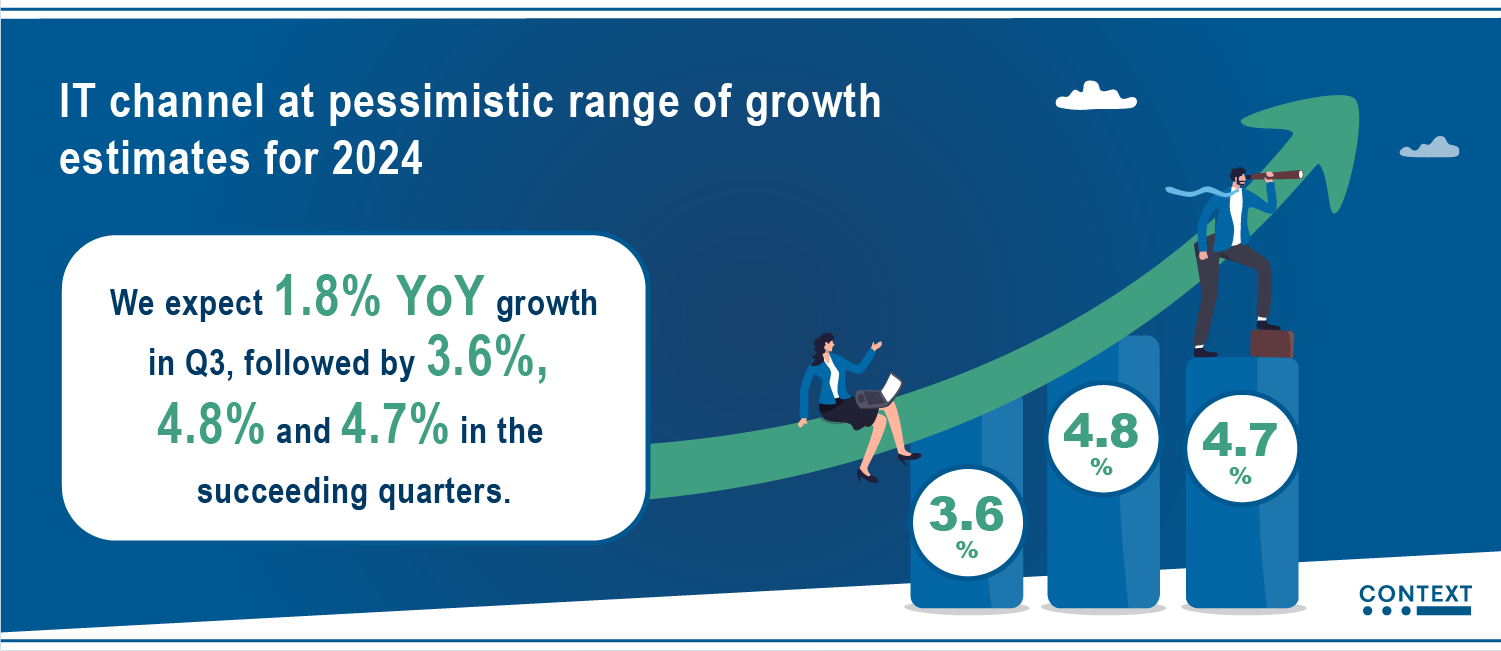

IT Channel at Pessimistic End of Growth Estimates for 2024

At the beginning of 2024, CONTEXT’s central

forecast for full–year revenue sales growth was 2.3% (±3%), which we

then revised down to flat growth in May. Although Q2 performed better

than expected, with 2.1% year–on–year (YoY) growth following four

consecutive quarters of negative growth, our central estimate for the

year remains modest at 0.3%. That said, the upcoming quarters are

expected to post improved revenue growth due to favourable

year–on–year comparisons. We anticipate 1.8% YoY growth in Q3,

followed by 3.6%, 4.8%, and 4.7% in the subsequent quarters. The

personal systems and software categories are leading the way, while

networking is dragging overall figures down following a strong 2023.

South African IT Distribution Sales Near 2023 Levels

It has been a challenging start to the year for

IT distribution sales in South Africa, but the situation is

improving. According to the CONTEXT Weekly Revenue Trend Index,

sales are approaching the 2023 average, represented by the index

baseline, thanks to significant public and private sector tenders.

Both consumer and business channels were nearly at the 100 baseline

in Q2. Only two categories, networking systems and servers, did not

show an upward trend during the quarter. In disk storage, a large

deal pushed revenue sales growth to 180 on the index. Looking ahead,

we believe AI, IoT, and edge computing will drive future growth in

servers and networking.

Consumables Update: Germany Rebounds as Ink Bottle Sales Surge

As of Week 32, Germany stood out in the ink

cartridges and bottles market, with sales growth nearing the baseline

of the Revenue Trend Index. This improvement is mainly due to consumer

demand. In fact, when considering consumer sales alone, Germany

recorded growth of 120 on the index around Week 32, driven by

back–to–school purchases. Ink bottles are performing well overall,

staying above the trend line, while cartridges remain significantly

below. Although ink bottle sales tend to be cyclical and

country–specific, they have stayed above 2023 levels for the

pan–European panel so far this year. When it comes to toners, Germany

is also leading, fuelled by demand from low–end consumer and SOHO

laser printer customers.

In Week 33, AI–Capable Notebooks Comprised 25% of Total Units

Across Europe

As of Week 33, AI–capable notebooks accounted for

just over 25% of the market, up from 23% the previous week. However,

this increase is mainly due to a decline in sales of non–AI–capable

devices, which saw a sharp drop after peaking at the end of July.

Sales of Copilot+ PCs have remained stable at around 2% of the market

during Week 33, the same share they have held for the past 4–5 weeks.

This has been driven by Qualcomm Snapdragon X processors, although

this week saw the first sales of units equipped with AMD Ryzen AI 300

chips. It is expected that AI–capable notebook sales will gain

momentum once there is more variety on the market and prices begin to

decrease in the coming months.

In the meantime, stay

up to date with the latest market intelligence for the

IT channel by tuning into

CONTEXT’s weekly IT Industry Forum webinars.