London, 18 July 2024 – Global 3D printer shipments

began the year in a similar fashion to how they ended in 2023 with

Q1–24 INDUSTRIAL Metal printer shipments rising in China, while

INDUSTRIAL Polymer shipments struggled in all regions, according to

market intelligence firm CONTEXT.

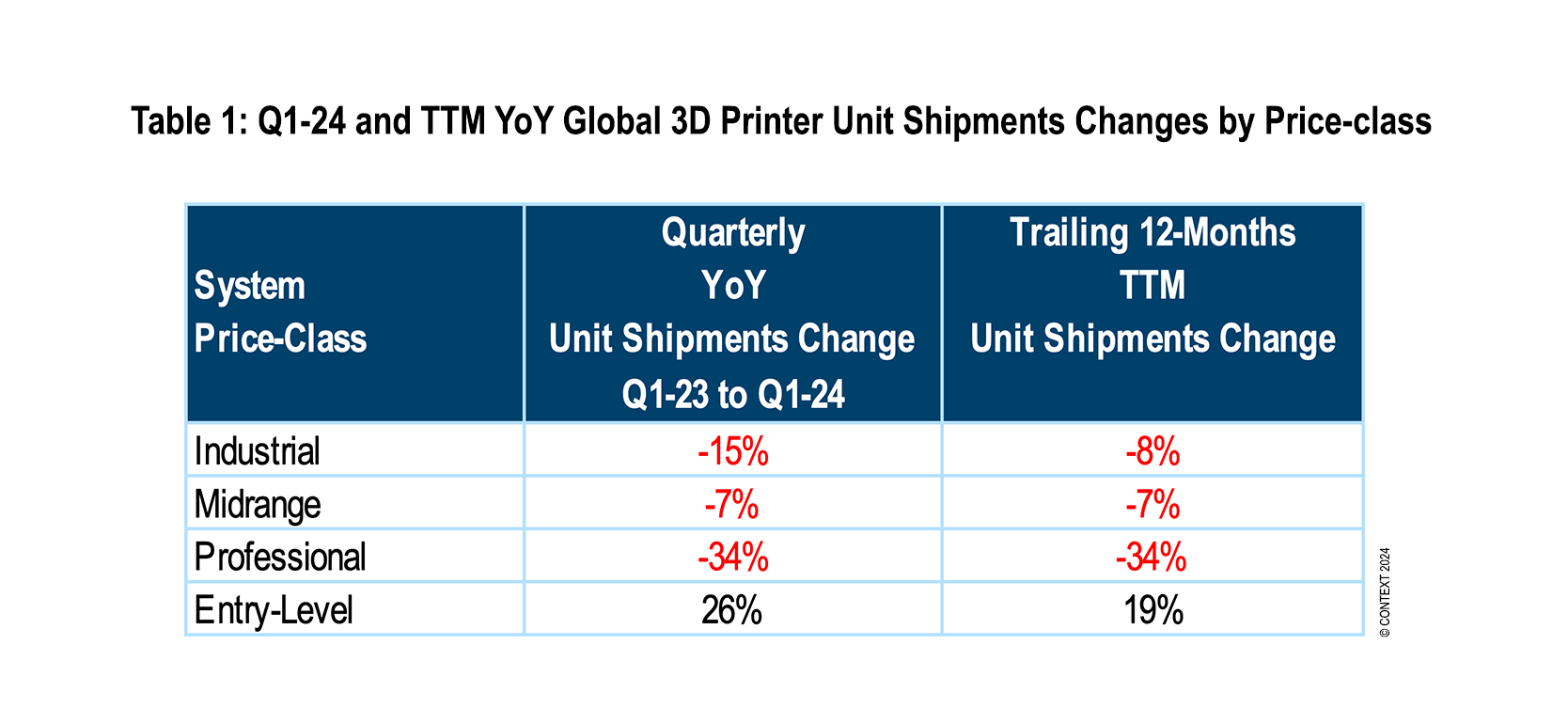

Global shipments of INDUSTRIAL Vat

Photopolymerization printers were particularly weak in all regions,

contributing most significantly to the overall –15% YoY decline for

the price–class. MIDRANGE printer shipments dropped –7% and the

PROFESSIONAL price–classed printer category continued to see sales

shift into the ENTRY–LEVEL price–class. PROFESSIONAL shipments dropped

significantly again in the period, down –34% from a year ago, while

ENTRY–LEVEL shipments rose, with global shipments up 26% from a year ago.

Regional moods were divided amongst Chinese

vendors – particularly those engaged in the Industrial Metal Powder

Bed Fusion side of the industry – were elated by their strong

domestic demand, while Western vendors noted continued end–market

challenges associated with low CapEx spending due to high interest

rates and sticky inflation. In the US and across Europe, the news

was not all negative however, with many vendors reporting strong

demand from domestic defence markets in the period.

INDUSTRIAL SYSTEMS

Global shipments for

all INDUSTRIAL price–class 3D Printers dropped –15% in Q1–24 and

were down –8% on a trailing–twelve–months–basis, according to latest

market insights by CONTEXT. From a materials stand–point, Polymers

and Metals collectively represented 96% of all INDUSTRIAL 3D Printer

shipments in the period with Polymer accounting for 50% of the

category shipment totals and Metal accounting for 46%. Of these two

main groupings, weak INDUSTRIAL Polymer shipments were the ones

pulling down the overall category performance Q1–24 seeing –29%

fewer printers ship in the period than a year ago. Conversely,

INDUSTRIAL Metal shipments were up globally by 10%. On a

Trailing–Twelve–Months basis (TTM), worldwide INDUSTRIAL Polymer

shipments are down –16%, while INDUSTRIAL Metal shipments are up 4%.

INDUSTRIAL POLYMER SYSTEMS

Weak shipments of INDUSTRIAL Polymer Vat Photopolymerization

printers across both the West (mostly the US and Western Europe) and

the East (mostly domestic China) pulled down the entire INDUSTRIAL 3D

Printer category. Shipments for INDUSTRIAL Polymer Vat Photo printers

were down –47%, mostly due to excessively weak shipments from the two

regional leaders in the category – UnionTech in China and 3D Systems

in the West.

Overall, nine of the top ten global players in

this space saw shipments fall from a year ago, most seeing shipments

down by double digit percentage points. Excluding Vat

Photopolymerization, shipments of all other INDUSTRIAL price–class

systems dropped only –1% from a year ago. Weak demand in the Dental

markets in both regions was reportedly the main contributor to the

YoY decline as high–inflation caused a shift in end–market demand

for more cosmetic dentistry.

INDUSTRIAL METAL SYSTEMS

Shipments for INDUSTRIAL Metal 3D Printers across the globe in

all modalities were up 10% YoY in Q1–24 with shipments for Metal

Powder Bed Fusion Systems – which accounted for the largest percentage

of printers at 74% – up 7% from a year ago.

Shipments of all Metal modalities were up in the

period with the exception of Material Jetting with Directed Energy

Deposition shipment up 21%, Material Extrusion up 32%, and Binder

Jetting up 15%.

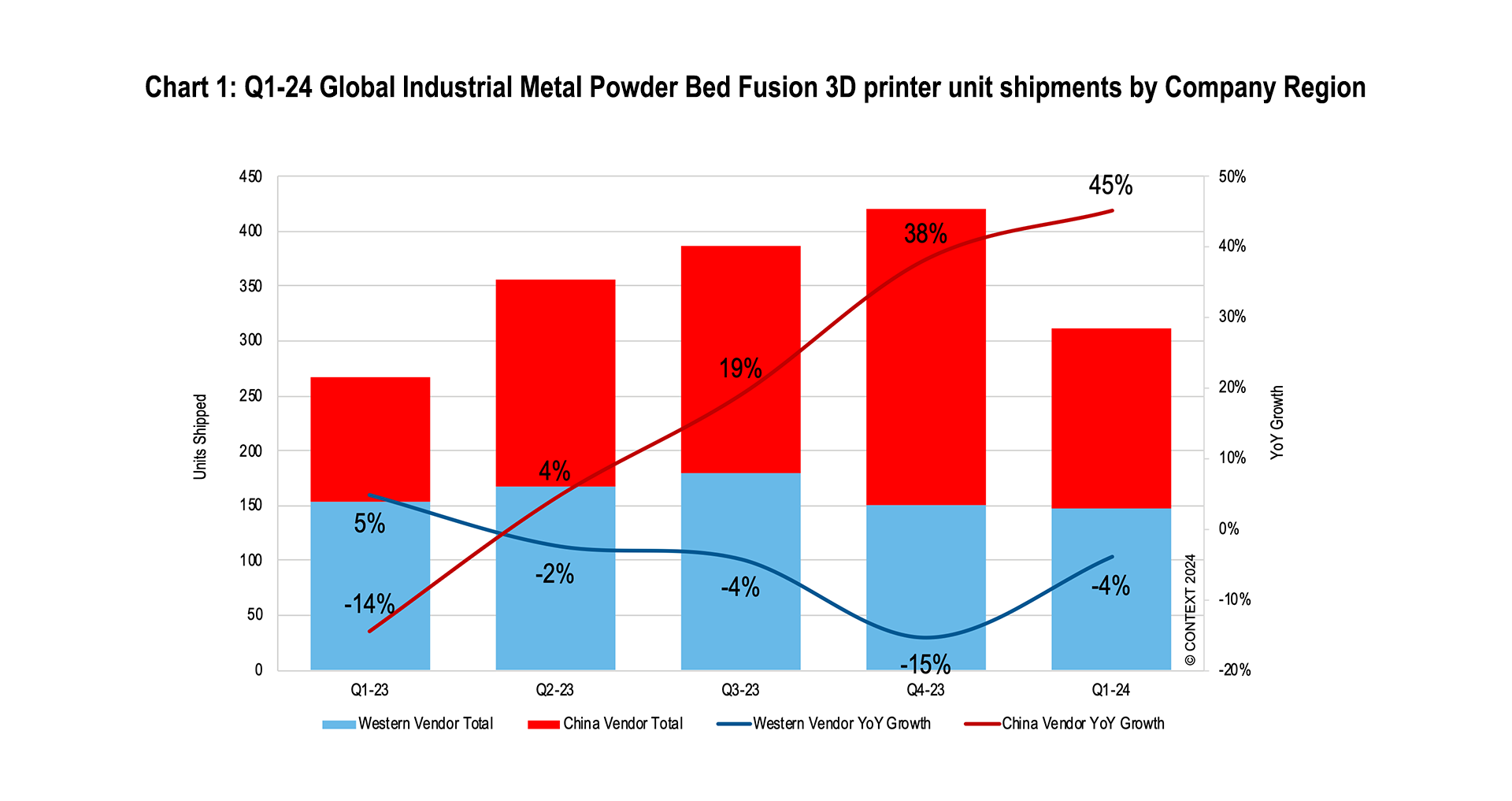

Demand for INDUSTRIAL Metal Powder Bed Fusion was

particularly strong in China with shipments from Chinese vendors up

45% in the period, while shipments of Metal PBF printers from Western

vendors down –4% from a year ago. Chinese vendors have seen YoY

quarterly shipments grow the last four consecutive quarters, while

Western vendors have seen four consecutive quarters of declining

shipments. Four of the top five global vendors for INDUSTRIAL Metal

Powder Bed Fusion printer shipments in the period (Eplus3D, BLT,

ZRapid Tech and Farsoon) were headquartered in China with Eplus3D

leading the industry in the period. Vendors focused on the West

continue do lead in System Revenue contribution with Nikon SLM

Solutions and EOS enjoying the top market share positions in Metal PBF

system revenues in the period. Nikon SLM Solutions was particularly

notable as the leader in large form–factor, multi–laser systems.

MIDRANGE SYSTEMS

MIDRANGE 3D Printer

shipments dropped –7% in Q1–24 mostly due to declining Polymer

Powder Bed Fusion printer shipments, which were down –14% YoY.

Demand was weak in both the East and West in this price class in

general however with shipments from China–based vendors down –1% YoY

and shipments from Western vendors down –9% in Q1–24. Of the Top

five global vendors in this price–class China’s ZRapid Tech was the

only vendor seeing YoY shipment growth, with strength not just in

SLA Vat Photopolymerization shipments but also with their low–end

Metal Powder Bed Fusion line. Other leaders in the Top five Stratasys,

UnionTech, Formlabs and 3D Systems all saw YoY shipment declines of

products in the price–class.

PROFESSIONAL SYSTEMS

Global shipments of products in the PROFESSIONAL price–class dropped

yet again in the period with –34% fewer products shipped globally in

Q1–24 than a year ago. This marked the eighth consecutive period of

YoY shipment declines in the category as inflation has largely

shifted a portion of this purchasing–base into the ENTRY–LEVEL. Of

the Top 10 vendors, all but two saw YoY shipment declines.

The period was one of transition as the two

price–class leaders Formlabs and UltiMaker both made significant new

product introductions. While both of these leading vendors had

historically found success through product extension into higher price

points, introducing more and more feature–rich products over time,

UltiMaker continued this tradition – and even elevated their product

portfolio into even a higher price–point. Their material extrusion

Factor 4, Formlabs has taken the opportunity to introduce a new

iteration of vat photopolymerization technology at a price–point

similar to its traditional sweet–spot.

ENTRY–LEVEL SYSTEMS

Shipments of ENTRY–LEVEL price–class 3D Printers continued to

accelerate in Q1–24, up 26% from Q1–23. Nine (9) of the Ten top

vendors in the space saw more printers ship in Q1–24 than a year ago

with Bambu Lab’s growth the most impressive. While Bambu Lab again

lead in growth, Creality remained dominant in the price–class and

alone accounted for 56% of all ENTRY–LEVEL price class 3D printer

shipments in Q1–24 with Anycubic a far distant #2 in the category. The

accelerating use of ENTRY–LEVEL price–point printers in more

professional end–markets – including on print–farms – continued to

help this price–class soar. Excluding Creality and Bambu Lab,

shipments for the rest of the price–class were up only modestly YoY

(9%.) Trying to capitalize on the success seen from Bambu Lab’s AMS

(Automatic Material System) multi–colour technology, many vendors

introduced similar technologies to the market in the period. The US

market remained the top end–market for ENTRY–LEVEL 3D Printer

shipments with 42% of the units shipping globally in Q1–24 shipping

into this region. Approximately 94% of all ENTRY–LEVEL 3D Printer

shipments across the globe in Q1–24 came from Chinese vendors.

OUTLOOK

Talks of

industry consolidation dominated recent conversations in the West,

highlighted by Nano Dimension’s planned acquisition of Desktop

Metal. Ongoing merger and acquisition rumours persist in the US and

Europe, with several publicly traded companies under strategic

review. In contrast, Chinese companies continue to thrive domestically

and focus on expanding their overseas business.

Western forecasts remain conservative, but strong

Chinese demand, especially for Metal Powder Bed Fusion solutions, has

led to a revised global industrial printer shipment forecast, now

projected to rise by 7% in 2024. Western defence sector demand from

companies like Nexa3D and Velo3D also supports this increase. The

MIDRANGE category forecast is now a modest 3% YoY growth, while the

PROFESSIONAL category is expected to decline by –1%. ENTRY–LEVEL

category growth is projected at 14%, driven by new market options

following Bambu Lab’s success.

Accelerated growth in the industrial price class

is anticipated in 2025 and beyond as the US and Europe stabilise

post–election cycles and interest rates drop. While system vendors

remain focused on further advancing Additive Manufacturing into

mainstream manufacturing, many strategic growth initiates are now

starting to also incorporate other digital production technologies

beyond just additive into their portfolios, as a way to accelerate growth.

* Price–class groups: INDUSTRIAL $100,000+;

MIDRANGE $20,000–$100,000; PROFESSIONAL $2,500–$20,000; ENTRY–LEVEL <$2,500