Welcome back to Forecast Fridays, where we predict

the latest trends and projections in the tech industry. In this

edition, we turn our attention to the enterprise servers and storage

markets, both of which faced challenges in the fourth quarter of 2023.

Q4 2023 Performance Recap: Servers and Storage Face Headwinds

As anticipated, Q4 2023 proved to be a

challenging period for both enterprise servers and storage. Server

revenues experienced a substantial decline of 27.2% year–over–year

(YoY). This drop was attributed to various factors, including

unfavourable YoY comparisons with Q4 2022, lower prices in specific

component categories compared to the end of 2022, and soft demand

due to economic uncertainties.

However, the situation was slightly more

optimistic than our forecast, with government tenders in Poland

playing a significant role, contributing €75M in

revenues–outperforming the UK and France and securing the

second–highest spot in Europe.

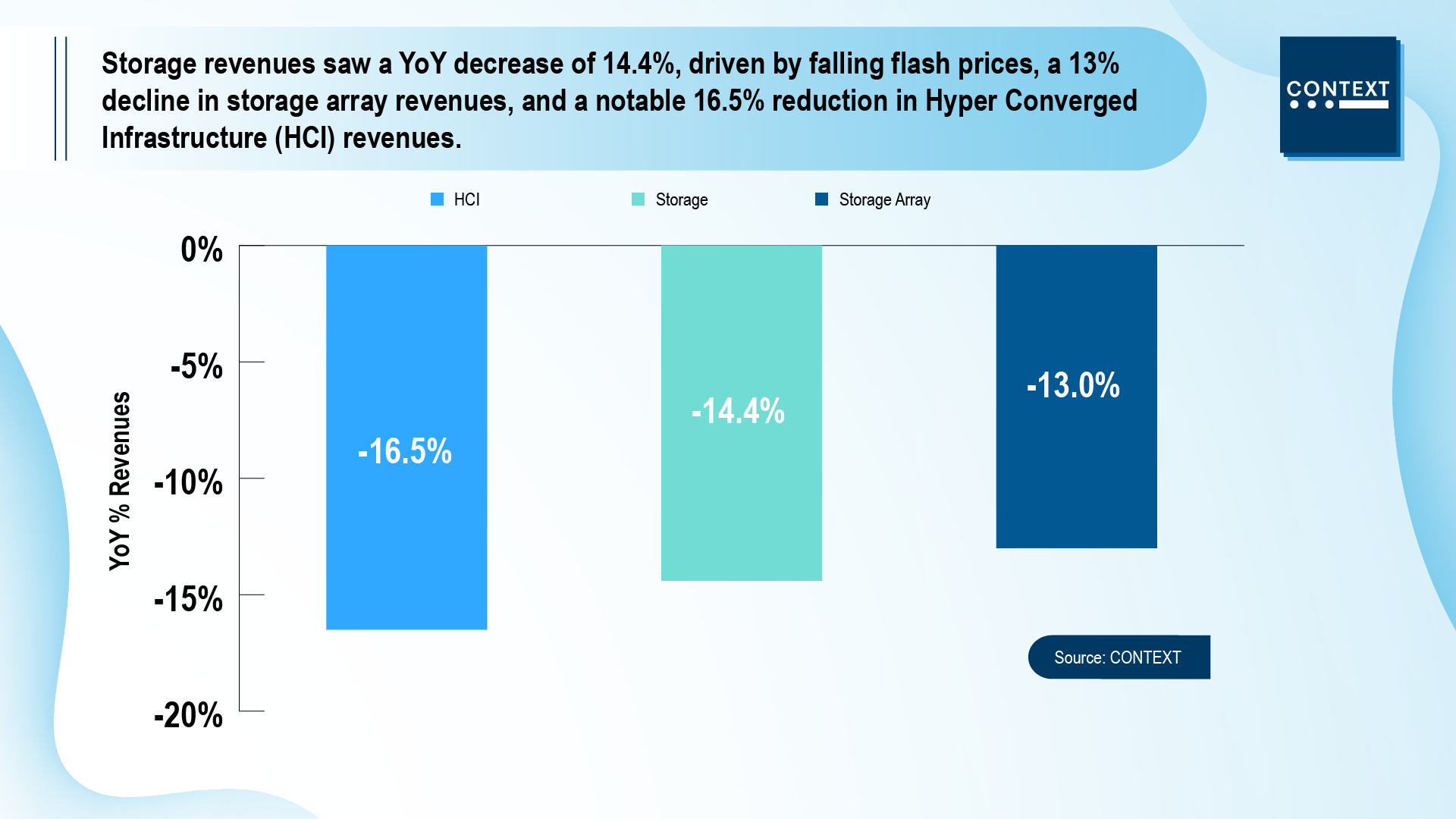

Similarly, storage revenues saw a YoY decrease of

14.4%, driven by falling flash prices, a 13% decline in storage array

revenues, and a notable 16.5% reduction in Hyper converged

Infrastructure (HCI) revenues. Germany’s market size played a crucial

role in the overall decline, with a 15% YoY drop in revenues. Notably,

Poland stood out as one of the few European countries experiencing

sales growth, recording a 15% increase in Q4 2023.

2024 Outlook: Anticipating positive H2 trends in servers

Looking ahead to 2024, the forecast for H1

remains cautious for servers due to unfavourable YoY comparisons and

a fragile economic landscape. However, a more positive outlook is

expected in H2, with potential interest rate cuts supporting

datacenter investments. The overall economic situation will be the

key determinant, with optimistic scenarios hinging on falling

inflation and lower central bank interest rates, encouraging

businesses to invest in infrastructure.

Factors such as pricing, impacted by RAM and SSD

manufacturers’ Q4 2023 price increases, along with geopolitical events

like the Red Sea situation, may further influence the market. Despite

longer server refresh cycles, potential upgrades could bolster market

performance. However, businesses may choose to hold onto legacy

equipment until the impact of AI technology on server revenues becomes clearer.

In summary, the expected server revenue growth

for the full year ranges between –3.7% and 4.1%, with flat

performance at the midpoint.

Factors Driving Storage Market Growth in 2024

The outlook for enterprise storage is more

optimistic for 2024 with +4% YoY as a midrange performance, despite Q1

2024 which we anticipate will decline between –16.2% and –7.6% YoY.

Flash price increases from Q4 2023 are

anticipated to continue through H1 2024, positively impacting YoY

comparisons. The surge in generative AI usage is predicted to drive

increased demand for storage as data volumes escalate with the

proliferation of AI applications.

Businesses will need to enhance storage capacity

and performance to accommodate complex and data–hungry algorithms,

making robust, scalable, and high-performance storage infrastructure

essential. Additionally, demand for HCI may receive a boost from an

expected server refresh cycle if economic conditions improve and

budgets expand.

As the tech landscape continues to evolve,

businesses must remain agile, adapting to emerging trends and economic

shifts to stay ahead in the dynamic world of enterprise technology.

Stay tuned for more insights in the next

Forecast Fridays instalment! Request your copy

of the full report

here.