London, 9 October 2025 – The global 3D

printer market continued to show starkly divergent trends in the

second quarter of 2025, according to the latest analysis by global

market intelligence firm CONTEXT. The consumer-centric Entry-level

market continues to excel while the high-end of the industry remains

stuck in slowdown mode as downstream capital spending stalls and

consolidation continues.

The trend of disparate market

performance continued into the second quarter. Weak demand from

tariff-paralysis and high interest rates made for difficult market

conditions in the Industrial and Midrange segments. In contrast, the

Entry-level space continued to thrive, with key players even making

moves to go public, highlighting the segment's sustained momentum.

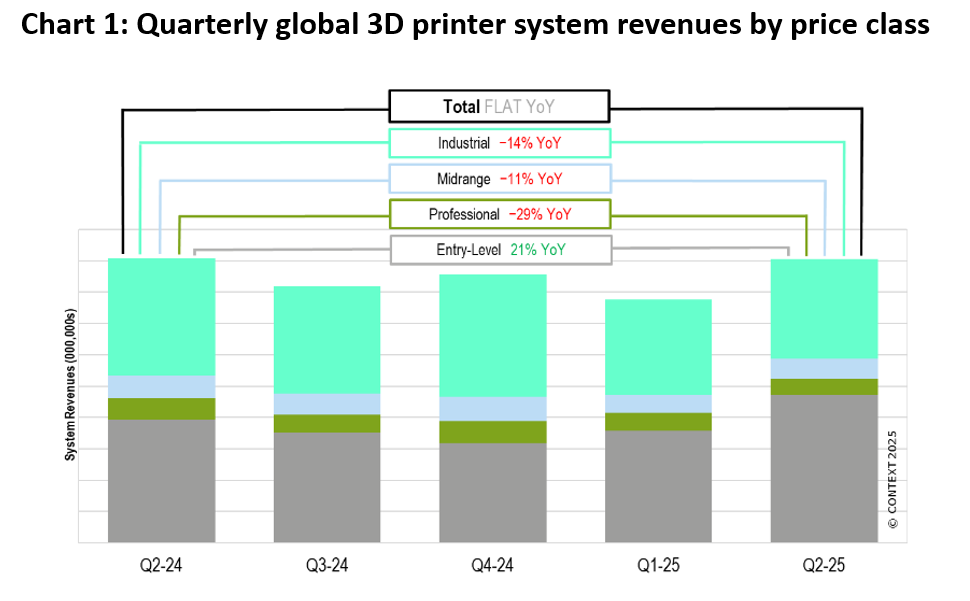

Overall aggregate hardware system

revenues remained flat year-on-year (YoY). A +21% surge in revenues

from Entry-level printers, driven by strong shipments from vendors

like Bambu Lab, was offset by significant downturns in all other price

categories. Revenues from Professional systems fell by -29%, while

Midrange and Industrial revenues dropped by -11% and -14% respectively.

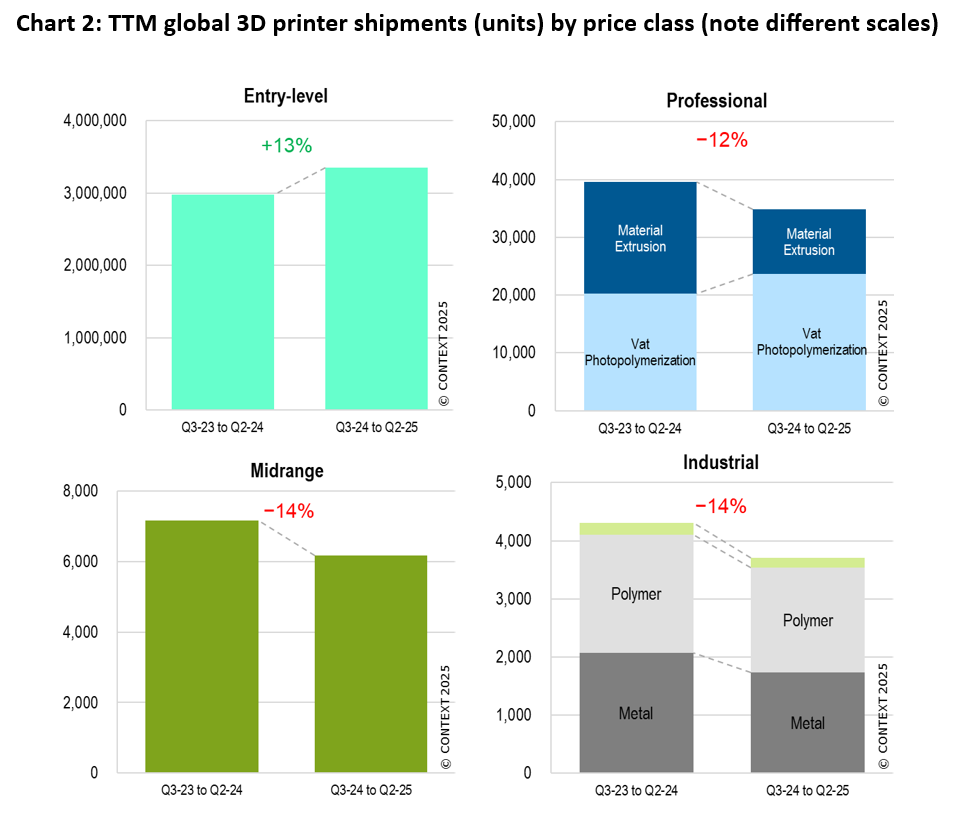

Industrial and Midrange Systems

High interest rates and the fallout

from widespread company consolidation created another challenging

quarter for the high-end of the market. Global Industrial 3D printer

shipments fell markedly in Q2 2025. This weakness was compounded by

business distractions from bankruptcies, such as that of Desktop

Metal, and complex mergers; the newly combined Nano Dimension

(including Markforged and Desktop Metal for the period) saw its

aggregate shipments of the three collective companies fall

precipitously from a year ago. However, there were bright spots: HP

saw impressive shipment growth in the quarter, largely driven by its

unique upgrade strategy, and Stratasys posted nice growth as well. In

the crucial metal PBF segment, China's Eplus3D took the top spot for

units shipped and, alongside Velo3D saw YoY unit shipment growth,

while stalwarts EOS and Nikon remained revenue leaders despite both

seeing marginal unit shipment declines from a year ago.

The Midrange category saw a similar

YoY shipment decline to the Industrial price-class. The downturn was

most pronounced for Western vendors, including 3D Systems (which

continues to get smaller each period) and Stratasys, while some

Chinese vendors like UnionTech saw shipment growth fuelled by domestic

demand. Flashforge, a standout performer on a trailing-twelve-month

basis, saw a small quarterly dip in shipments in Q2 2025.

Professional Printers

The significant YoY drop in

shipments of Professional printers was driven entirely by the

collapse of the material extrusion (FDM/FFF) category, where

shipments cratered. This segment, once the dominant force in the

professional space, has been significantly impacted by the rise of

capable, lower-priced Entry-level machines. In contrast, vat

photopolymerization shipments in this category held steady, as

vendors like Formlabs continued the successful refresh of key

product lines.

Entry-Level Printers

The Entry-level category was again

the standout performer, again seeing strong YoY shipment growth.

This growth was driven by continued strong demand for products from

brands like Bambu Lab, which not only saw its shipments rise again,

but also introduced new products. The quarter was also notable for

the news that Creality, a long-time leader in the space, issued

plans to go public. While Creality saw a shipment decline as it

realigns its reporting for its IPO, the move signals the growing

maturity and financial significance of the consumer market. The

segment also saw record-breaking crowdfunding success for

Snapmaker’s new multicolour FDM printer, demonstrating robust

consumer enthusiasm.

Outlook

While the Entry-level segment

remains strong, persistent headwinds from high interest rates,

tariffs, and inflation are expected to continue suppressing capital

expenditures for high-end systems for the remainder of 2025. In a

welcome move for the industry, the US Federal Reserve cut interest

rates in September 2025, with more cuts anticipated before year-end.

However, it is expected that it will take several such cuts before

capital spending is fully restimulated.

While many OEMs continue to report

strong end-market engagement and pent-up demand, the recovery for the

Industrial segment now looks to be pushed out. We don’t project a

significant rebound to begin until 2026, when lower interest rates are

expected to finally unlock renewed investment in capital equipment.

Regional on-shoring initiatives and the need to overcome supply chain

disruptions still present major opportunities for agile additive

manufacturing once business conditions improve.

* Price classes: Entry-level

<$2,500; Professional $2,500–$20,000; Midrange $20,000–$100,000;

Industrial $100,000+