With the start of Q4—the strongest quarter of the

year—the IT channel is turning its attention to the run-up to

Christmas. However, our September webinars reflected on highlights

from August, which is often a slow period for European markets as many

workers head off on holiday. As always, your best source of regular

market insight is CONTEXT’s weekly webinar briefings, where we share

key data and trends to support data-driven decision-making.

Among this month’s highlights are positive news

for resellers, a strong Q3 in the UK, rising cybersecurity sales,

and a notable drop in warranty sales. Here’s our pick of the top

stories in more detail:

Reseller Count Dips in August, but Overall Picture is Positive

Reseller activity across the main European

markets saw a downturn in August. The number of active resellers

purchasing from distributors dropped by 9% on average year-on-year

(YoY) across Italy, Spain, France, and the UK—with Italy

experiencing a -12% decline. However, the overall health of

resellers remains positive, with YoY spending up in all countries

and average revenue per reseller rising in France and the UK, likely

due to a reduction in reseller numbers overall. UK resellers are

notably ahead, with average revenue reaching €130,000 per business,

compared to less than €60,000 in second-placed France.

UK Drives Strong Cybersecurity Performance Year-to-Date

After a slow start to the year, the Channel's

cybersecurity sales have begun to pick up, driven by

ransomware-as-a-service and supply chain threats impacting critical

infrastructure firms. The latest CONTEXT figures show 3.6% revenue

growth year-to-date (YTD) across the region as of approximately week

36. This growth is largely driven by positive performance in the UK,

although all markets are trending upward, with the exception of

Germany, as Q3 comes to a close. SaaS sales have risen by 6%, and MSP

sales are up 2% YoY, although this is down from double-digit increases

seen earlier in the year.

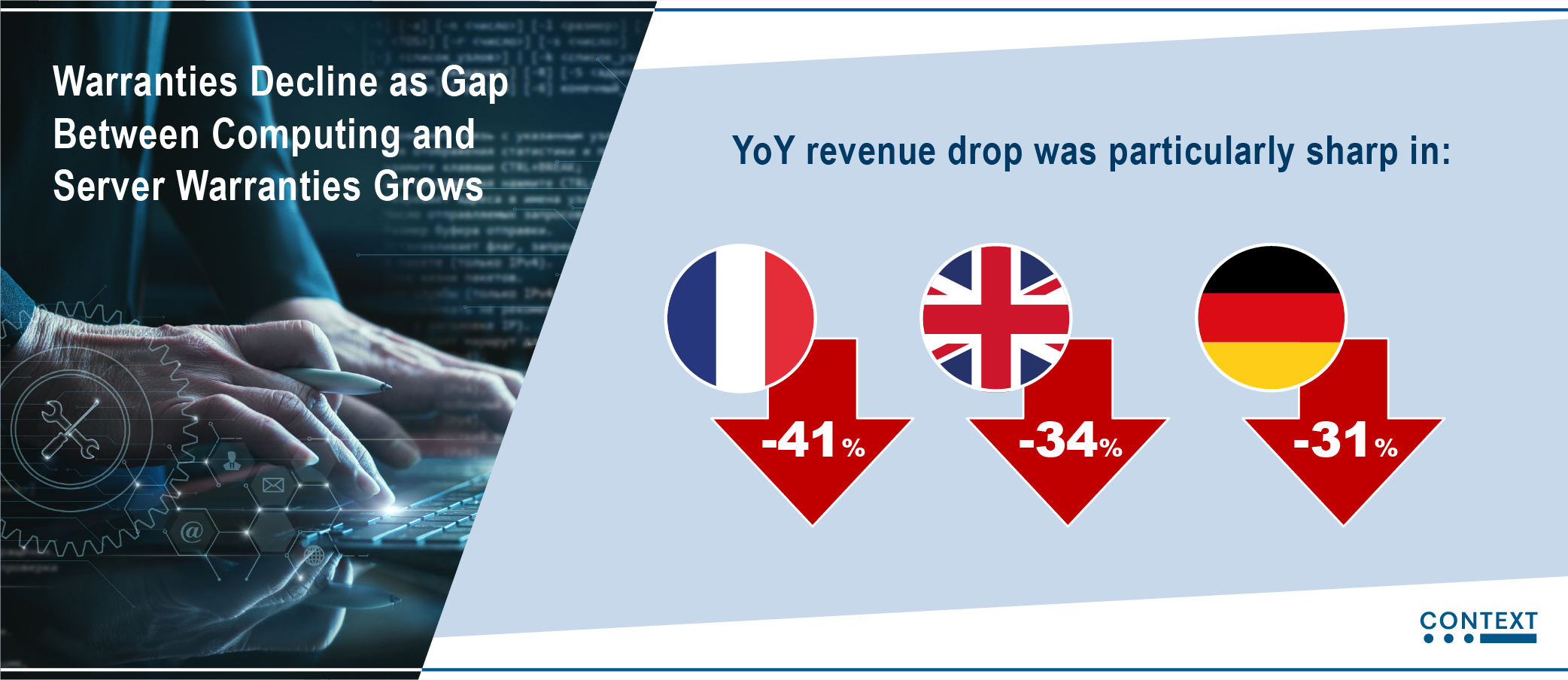

Warranties Decline as Gap Between Computing and Server

Warranties Grows

Week 35 saw significant declines in revenue

growth for the warranty market, covering standalone warranty

extensions, warranty upgrades, and post-warranty packages for

PC/server repairs. The YoY revenue drop was particularly sharp in

France (-41%), the UK (-34%), and Germany (-31%). However, computing

warranties outperformed server warranties. This could be due to an

increase in home working, growing consumer confidence, and the

technical complexity of modern PCs, which makes warranties a safer

option than troubleshooting. Meanwhile, the growth in cloud

computing has reduced the need for organisations to maintain

on-premises servers, with many also consolidating data centres to

cut costs.

UK Enjoys a Stellar July and August Thanks to Strong SMR Sales

Bolstered by 0.6% GDP growth in Q2, a new

government, and falling interest rates and inflation, the UK channel

has performed well. Distribution revenue rose by 7.5% quarter-to-date

to the end of August, compared to 1.4% in Germany, 1.2% in Italy, -5%

in France, and -5.1% in Spain. However, this growth follows favourable

comparisons due to the -12.5% decline in the UK’s Q3 growth in 2023.

Security and data management software, servers, and storage sales all

performed strongly as smaller companies invested more in digital transformation.

In the meantime, stay informed on the latest IT

channel trends and market intelligence insights by

registering to join CONTEXT’s weekly IT Industry Forum

webinar below: