Industrial 3D Printer Accelerants in Q4 2021: Metals, China and Aerospace

Industrial metal 3D printers saw impressive +24% shipment growth in 2021

LONDON, 12 April 2022 - Global shipments of Industrial* 3D printer systems accelerated again in Q4 2021 giving a clear sign that the global 3D printer market is being renewed and is no longer in recovery mode, according to CONTEXT, the market intelligence company.

Global shipments of high-end printers were not only greater than those seen in the same quarter of the previous year, but also finally above the pre-pandemic levels of Q4 2019. Industrial printers (those costing more than $100,000) accounted for 61% of hardware revenues in Q4 2021 and 58% of revenues for the year as a whole. Unit shipments in this segment were up +11% in the last quarter of 2021 and up +22% compared to the pre-Covid Q4 2019.

Annual shipments of Industrial systems were up +29% on Covid-ravaged 2020 and even showed a slight increase (+1%) on 2019 thanks to accelerating sales in the second half of the year. Hot areas of growth in the final quarter of last year were metal 3D printers, the domestic Chinese market, and end-user industries such as aerospace where accelerated activity by privatised space companies highlights key advantages of additive manufacturing (AM).

Metal Rising

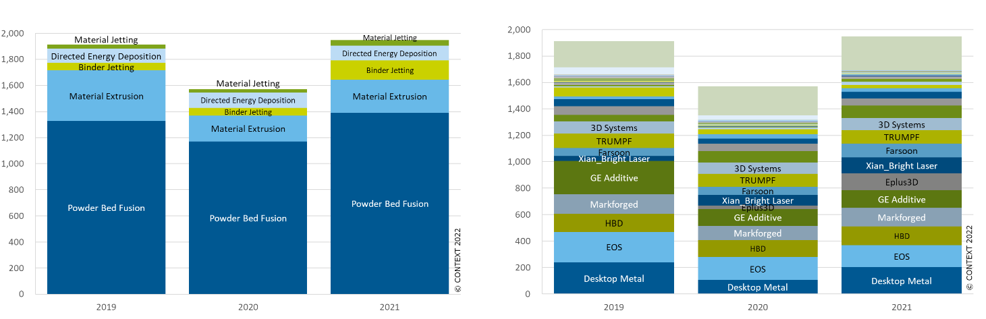

CONTEXT's quarterly market tracking shows that while areas such as composites and ceramics continue to see nice growth in other printer price classes, the Industrial 3D printer market is largely characterised by machines focused on either polymers or metals which, in aggregate, made up 98% of Industrial unit shipments in 2021. In 2021, industrial polymer printer shipments outpaced those of metal machines by 63% to 35%, and AM machines focused on printing metals accounted for 53% of Industrial hardware revenues. While there are several different methods for printing metal, laser powder bed fusion remains the most dominant technology, accounting for 71% of metal machines shipped over the year. Binder jetting technology saw the most impressive gains for the year, however, with shipments of this type of printer up +145% in 2021.

When all types of metal machines are considered, Desktop Metal lead the category in total printer shipments in 2021 but different vendors lead in different modalities. EOS was the leading vendor in the largest segment (powder bed fusion) and global leader in revenue terms; Markforged led in material extrusion; Desktop Metal (which grew organically as well as by acquisition of key competitor, ExOne) in binder jetting; TURMPF in directed energy deposition; and Optomec in material jetting. Across all regions and modalities, +18% more metal machines were shipped in Q4 2021 than in the same period of the previous year, and annual shipments were up +24%.

Chart 1: 3-year Industrial metal 3D printer shipments by process and vendor

Regional Shipments - China's Strength

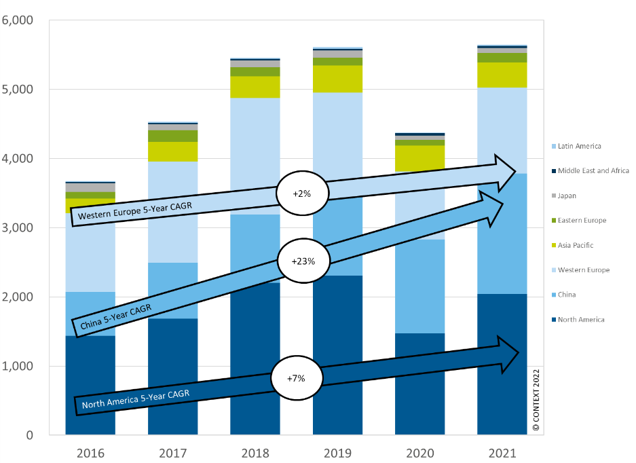

Domestic shipments into China represented the largest area of regional growth in Q4 2021; they were up +15% compared to +13% in Western Europe and +11% in North America. China was the second-largest market (after the US) for $100,000+ 3D printer systems of all material types. While China's rise over the quarter was impressive, it is only the latest input into even more impressive growth over a several-year timeframe. It was the only region to see increased shipments of Industrial 3D printers in 2020 (+4%) and has a five-year compounded annual growth rate (CAGR) of +23% - compared to +7% in North America and +2% in Western Europe. China's UnionTech was the leading vendor globally in both Q4 2021 and for the year as a whole, thanks to its strength in polymer systems. Four of the leading metal 3D printer companies - HBD, Eplus3D, Xi'an Bright Laser Technology (aka BLT) and Farsoon - are Chinese.

Chart 2: Q1-Q3 2021 Global 3D Printer Shipments: Market Leaders by Class, Material and Process

Rising Industrial End-Markets

Metal 3D printing has grown hand-in-hand with the development of new rockets and satellites, and with the general emergence of the private space race. Able to quickly print intricate parts in volumes commensurate with the needs of the industry, metal AM is tailor-made for this exciting new field. In the impressive order books of two up-and-coming metal powder bed fusion companies, Velo3D and SLM Solutions, many customers are aerospace. With international business travel still limited, commercial aviation has been slow to recover from the pandemic but demand from the ‘space' side of aerospace has more than made up for the shortfall. Other hot markets for metal AM machines in 2021 and into 2022 are energy and those parts of the automotive industry focused on electric vehicles.

A Look Ahead

While a strong H2 2021 and growing backorders set the stage for a strong 2022 in industrial metal 3D printer shipments, other technologies are also expecting significant growth in the year ahead. Demand for clear dental aligners and digital dentures looks set to remain strong and will continue to drive sales of certain polymer printers. Leading vendors in the Industrial polymer space - including UnionTech, Stratasys, HP, Carbon, 3D Systems and EOS - all saw growth in 2021. CONTEXT's quarterly market analysis reveals that machine shipments overall were up +5% in Q4 2021 and, more impressively, +31% in the year as a whole. Many vendors report renewed interest in AM as companies look at accelerating serial mass production in response to broken supply chains. This year will also see the shipment of new technologies from some of the world's largest 3D printing companies such as Stratasys and 3D Systems. History has shown that end markets are always eager to purchase the latest 3D printer technology, especially when offered by the world's leading companies in the space. When well-funded companies with good distribution infrastructures and strong marketing and PR efforts expand their portfolio into adjacent technologies, it has traditionally elevated the AM market. It will do this again in 2022, with Industrial shipments on course to grow by +22% over the year.

* Price-class categorisation of PERSONAL (<$2,500), PROFESSIONAL ($2,500-$20,000), DESIGN ($20,000-$100,000) and INDUSTRIAL ($100,000+) based on fully assembled, finished-good products; new KIT&HOBBY class defined by DIY assembly required.

About CONTEXT

CONTEXT's market intelligence, performance benchmarks and opportunity analysis empower clients to optimise operations and accelerate tomorrow's revenues. With over 35 years of industry partnership and experience reporting on large datasets, CONTEXT delivers analytics at all points in the value chain, providing clients with actionable insights rooted in concrete data and a profound understanding of customer needs. CONTEXT is headquartered in London, with over 300 staff across the world and in 2019 was recognised as one of the UK's Best WorkplacesTM by Great Place to Work®.

Press Contact

Funda Cizgenakad

T: +44 7876 616 246

E: Funda@contextworld.com