Every week, CONTEXT offers a snapshot into the latest

IT channel industry trends, based on its market data and expert

analysis. This month, our weekly IT Industry Forum webinars delved

into the relative strengths and weaknesses of the Indian and UK

markets, highlighted a reasonable start to the year for PCs, and

uncovered more insight into routes to market (RTM).

Here’s more on our pick from February.

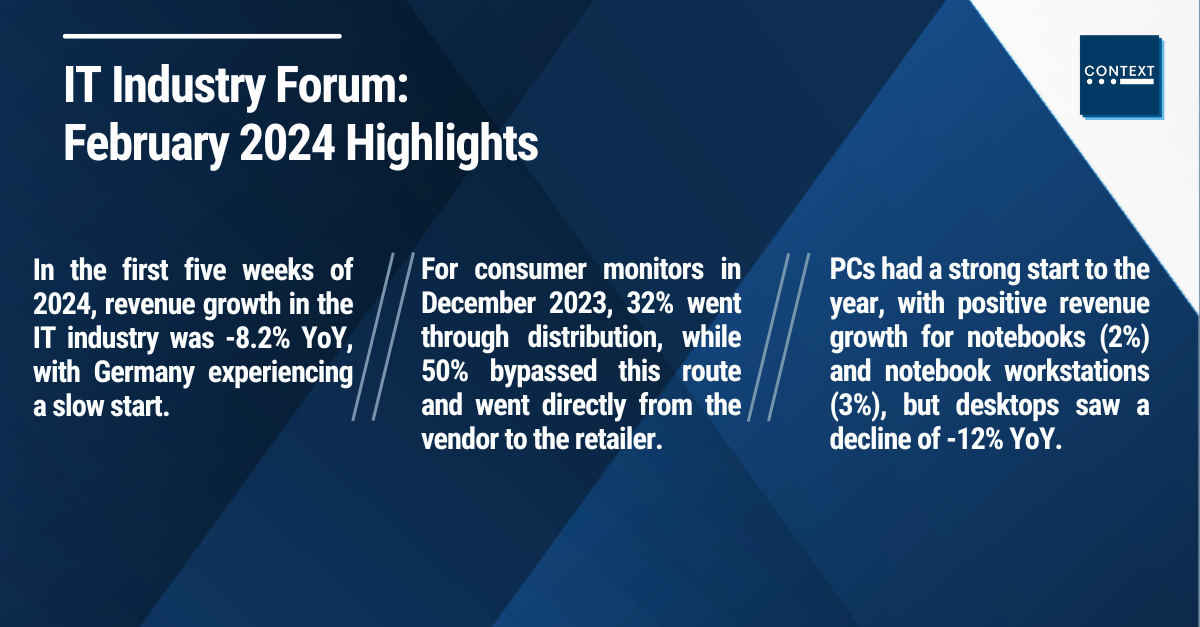

A slow start to the year

CONTEXT figures for the first five trading weeks

of 2024 recorded –8.2% year–on–year (YoY) revenue growth. Germany

started the year particularly badly with little or no business

investment. Poland stood out with 3% YoY growth in the period. And

while Spain had a slow start to 2024, this came on the back of a

strong January 2023. The retail channel remained strongest, boosted

by consumer growth, with corporate reseller recording –16% YoY on a

day–adjusted basis. The month was below CONTEXT’s forecast in

infrastructure, peripherals, software, and telecoms – although

things are likely to improve this quarter, with comparatives getting easier.

RTM for monitors

CONTEXT delivers new insights for our clients to

drive more effective channel decision making. That’s why we recently

started analysing routes to market (RTMs) to understand better how IT

products reach the end user. To do this, we take information from our

panel of distributors and combine it with a new retail panel and

corporate reseller data, as well as selling and shipment data from

vendors. In terms of consumer monitors in December 2023, we can see

that 32% went through distribution but 50% bypassed this RTM, going

direct from vendor to retailer. Yet on the business side it was a

totally different story: distribution being the clear leader.

For PCs, 2023 showed retailers building strong

relationships with vendors, as was the case in 2021 and 2022. And for

business PCs again most sales came via distribution. In many cases,

small and medium resellers bought from distributors to sell to SMBs.

France appeared to be an outlier, with corporate resellers maintaining

strong relationships with vendor and bypassing distribution.

PCs start the year well

It was a positive start to the year for PCs, with

revenue growth for notebooks (2%) and notebook workstations (3%)

hitting positive figures, although desktops were down by –12% YoY.

This can be explained by easier YoY comparisons. January 203 recorded

revenue growth of –33% YoY, for example. An improving stock situation

is also partly responsible. And there are pockets of growth such as

Germany, which is improving from a low base, and France, trending

higher than the past two years.

Business notebooks were trending lower than last

year, reflecting a challenging year, especially in Germany, although

at the other end of the spectrum Italy is benefiting from the impact

of strong education sales. January benefitted from back orders, a

factor that may continue to drive growth in the rest of Q1. Although

macroeconomic headwinds continue to impact investment, there is an

improvement in performance which we expect to continue.

An Indian snapshot

CONTEXT’s reach extends way beyond Europe. A case

in point was our recent roundup of the Indian IT channel market. It’s

a big year for the world’s biggest democracy as it goes to the polls.

The government’s plans to offer 50–year interest–free loans to

start–ups could help spur R&D to 3% of GDP. The Reserve Bank of

India is forecasting overall GDP growth in fiscal 2024–25 of 6.5%,

although high inflation remains a risk and debt–to–GDP is high at 90%.

Government investment in energy and EVs and GenAI–driven upskilling

offer hope for the future.

Telcos are finding it tough to monetise their

investments in 5G, although there’s plenty of room for smartphone

adoption to grow – potentially spurring revenue here. And the Indian

PC market has grown about 40% from pre–COVID to last year.

Is the UK turning a corner?

It is no surprise to hear that the UK is

struggling economically at the start of 2024. Inflation was

stubbornly high at 4%, with base rates kept at 5.25%, impacting

borrowing for businesses and consumers. The country has been in a

mild recession since the second half of 2023 with GDP growth at

nearly 0% since early 2022. However, there have been some bright

spots: Google announced plans to invest $1bn in its first UK

datacentre while Microsoft is ploughing in $3.2bn into its

datacentre and AI skills and training for over one million people.

Q4 2023 was weak and the year was a tough one

overall for UK distributors. Things may be slowly moving in the right

direction: after big declines in Q2, Q3 and Q4 2023, the first seven

weeks of 2024 only saw a 3.5% YoY revenue decline. Business channels

are key for UK distribution, comprising between a third and three

quarters of total revenue share, so it’s positive to see it above the

revenue trend index line and the European line.

To find out more on these and other market

trends, tune into our weekly IT Industry Forum

webinar by registering here.