London, 16 January 2024 – Shipments of 3D Printers struggled in many

segments across the globe in the third quarter of 2023 as key

end–markets fought against inflation and high interest rates. While

publicly traded 3D Printing companies made most of the headlines in

the industry in the second half of the year, they were responsible for

just 33% of recent global system revenues. Almost none of them –

whether “pure play” businesses deriving most or all of their revenues

from 3D printing or larger firms offering 3D printing systems and

services as part of a portfolio* – have a significant presence in the

hot Entry–level sector of the market. Most focus on Industrial systems

with just over half (51%) of Q3 2023 revenues in this price class

coming from publicly traded companies. Many public 3D printing firms

in the West began shifting their attention from market growth to

profitability and have recently been distracted by failed mergers and

layoffs. Although these woes were reflected in the wider global market

as well, there were pockets of opportunity and glimpses of strength in

some 3D printer segments, especially in the often–overlooked

Entry–level portion of the market.

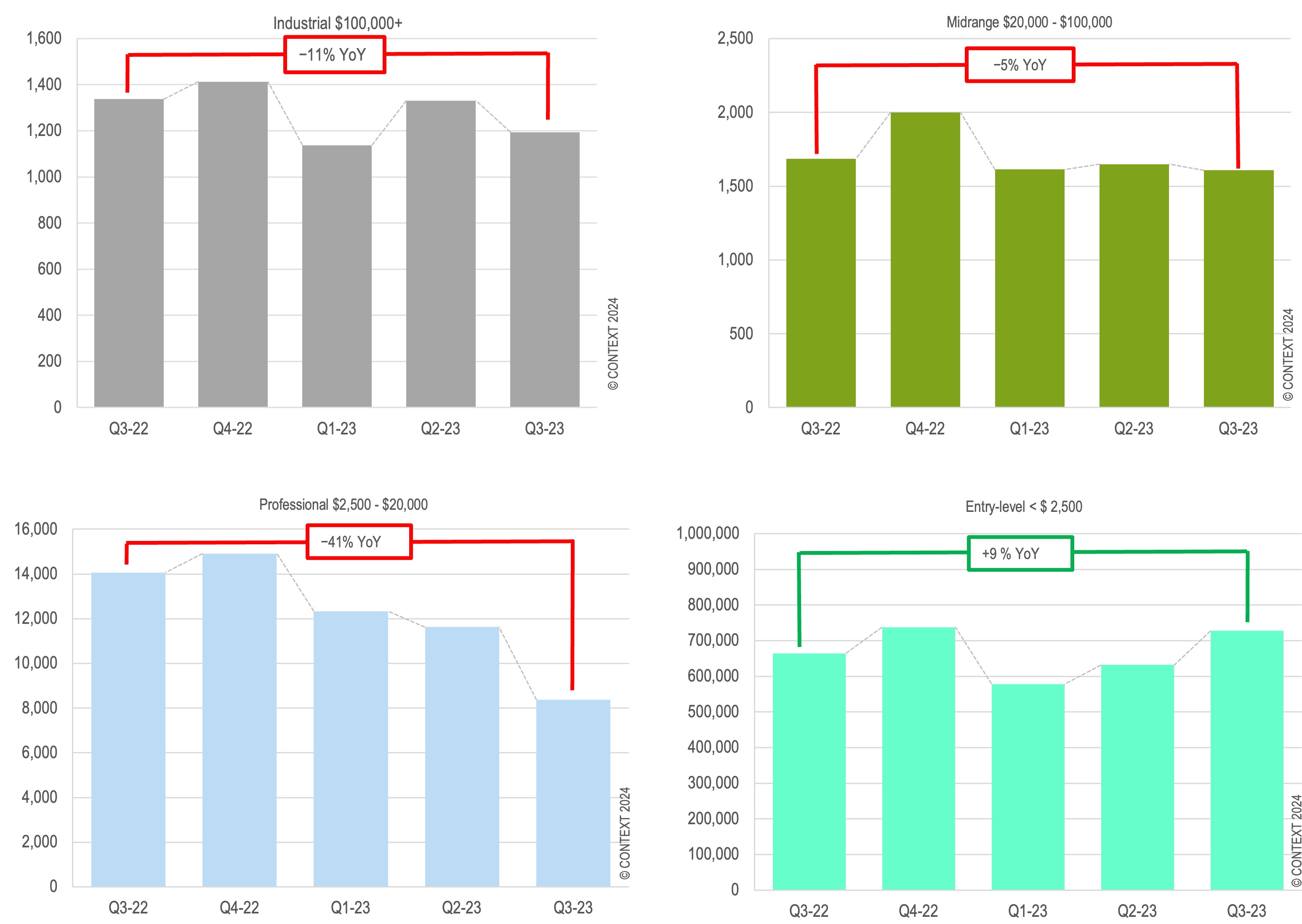

Chart 1: Global 3D printer system

unit shipments by price class

(note different scales)

INDUSTRIAL SYSTEMS

Global shipments of $100K+ 3D printers dropped –11% year on year

(YoY) in Q3 2023. Industrial polymer printer shipments dropped –17%

while Industrial metal printer shipments were down –3%. Shipments of

Industrial printers to China, which continues to be the largest market

for this price class, were –16% less than in the previous year mostly

due to weak polymer printer shipments. Vat photopolymerization

printers –the largest category of the polymer printer segment –

performed particularly poorly (if excluded from the analysis, then

Industrial polymer printer shipments were actually up 2% from a year

ago). Reduced demand in certain dental end market segments contributed

to poor results for some companies (such as 3D Systems) but the Covid

pandemic is still casting a long shadow over global growth figures.

The recent performance of market leader UnionTech has been lumpy and

inconsistent, and shipments dropped by –28% YoY in the period partly

because the comparison is to a time when the company was in

accelerated recovery from the Shanghai lockdowns of Q1 and Q2 2022. In

spite of all this, Q3 2023 global revenues from Industrial printers

were up 2% on the previous year.

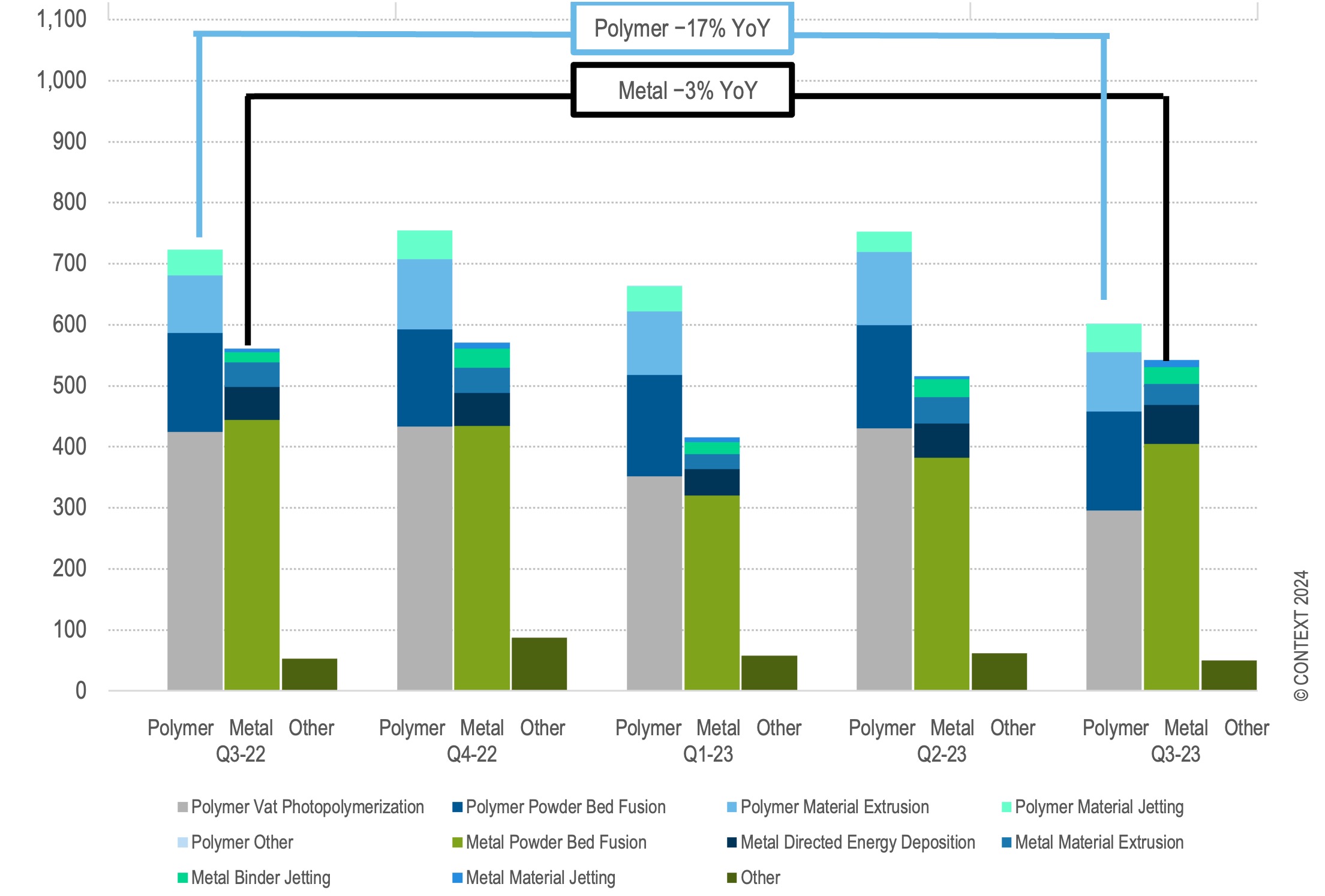

Chart 2: Global Industrial 3D

printer system unit shipments by material and

process

INDUSTRIAL METAL PRINTERS

Industrial metal 3D printer shipments were down –3% in Q3 2023

with most of the shortfall coming from a –9% fall in those of powder

bed fusion (PBF) systems – the largest (and most strategically

important) category. There were YoY shipment falls for Industrial

metal printer shipments in the two top regions in Industrial metal

shipments: China (–8%) and North America (–6%). However,

inflationary price increases and the growing popularity of larger

build–volume, multi–laser powder bed fusion systems – initially from

Western vendors such as Velo3D and Nikon SLM Solutions but now also

from Chinese companies including Farsoon, Eplus3D and Xi’an BLT as

well – mean that overall metal revenues were 8% higher than in Q3 2022.

INDUSTRIAL POCKETS OF GROWTH

While shipments of most Industrial metal 3D printer systems were

down in the period, one modality seeing strength was the Directed

Energy Deposition (DED) segment. Recent quarters have seen the

emergence of new entry–level products in this segment with Spain’s

Meltio driving the charge and now leading the category in

market–share. The DED category saw further growth outside of the

low–end as well as Australia’s SPEE3D accelerated defence shipments to

support the war effort in Ukraine. Pockets of growth were also seen in

some polymer segments as well with excellent YoY growth in shipments

of polymer PBF systems from one of the biggest companies in this

category, EOS. Meanwhile, Stratasys, one of the largest and

highest–profile global vendors, saw a healthy 11% YoY increase in

shipments of its wide range of Industrial polymer printers.

MIDRANGE SYSTEMS

In Q3 2023, Midrange printer shipments fell –5% YoY (–2%

sequentially). The drop would have been worse were it not for two

factors that also affected results in the previous quarter: (1) strong

shipments of a new class of low–end PBF systems, mainly from Formlabs;

and (2) rising domestic shipments in China of vat photopolymerization

printers, almost exclusively from UnionTech. If Formlabs and UnionTech

are excluded from the analysis, then shipments in this price class

would have been down –17% as key market leaders performed poorly:

shipments for product in this category were down –17% for Stratasys,

–28% for 3D Systems and –33% Markforged. Recognising challenges in

this price class, companies like Formlabs have adeptly added products

in new modalities and at new price points to their offering. This

portfolio–expanding tactic, which has been used time and time again in

the global 3D Printing market over recent years, is a recipe for

success that not only helps the innovating company but also lifts the

entire market.

PROFESSIONAL SYSTEMS

The Professional price class continued its downward trajectory

with –41% fewer printers shipped in Q3 2023 than a year before. This

is the sixth consecutive quarter in which global shipments have

fallen YoY and the third in which the drop has been –30% or more.

The strategy in recent years of market leaders UltiMaker and

Formlabs had generally been to offer more feature–rich products at

incrementally higher price points and, until recently, customers

have been receptive. However, in these inflationary times, demand

has clearly shifted to “good enough” solutions that can be found in

the Entry–level price class. With the exception of newcomer Nexa3D,

every vendor of Professional printers saw a double–digit YoY decline

in shipments of such products in the period.

ENTRY–LEVEL SYSTEMS

(This price class includes all 3D printers costing less than

$2,500 and combines CONTEXT’s previous Personal and Kit&Hobby categories.)

There was 9% growth in shipments of Entry–level 3D printers in Q3

2023, thanks largely to the cannibalization of sales from more

expensive Professional printers. End–market buyers in many sectors –

including dental, automotive, medical & healthcare, aerospace,

jewellery and consumer products – are increasingly recognising that

they can get similar functionality from much cheaper models so these

printers are no longer the preserve of hobbyists and general

consumers. While China’s Creality continues to stand head and

shoulders above other vendors in terms of global market share, recent

growth is best exemplified by brands like Bambu Lab (in the FDM space)

and Elegoo (in the LCD space).

OUTLOOK

A challenging 2023 has set the stage for a rebound and 3D printer

shipments look to accelerate in the years to come. Currently it

appears that global interest rates will remain elevated through at

least the first half of 2024, however which could mean Industrial

system shipments remain stagnant in the near term. Fears of regional

recessions have largely abated and the fundamental value of additive

manufacturing is well recognized across industries, clearing the way

toward accelerated growth once the cost of capital lowers in the

second half of the year and on into 2025.

Although the market may appear to have settled after the very

public failed mergers of 2023, many companies have openly stated that

they are more privately investigating strategic alternatives, meaning

that sales, mergers, acquisitions and divestures may yet lie ahead.

Indeed, as 2023 closed, Nano Dimension renewed its offer to take over

Stratasys with other companies – like BigRep – also separately

announced plans to go public in the year. An additional area ripe for

investment is the Entry–level category as more and more companies have

come to recognise this recently overlooked category.

* Pure 3D printing companies include Stratasys, 3D Systems,

Desktop Metal, Velo3D, Markforged, Prodways, voxeljet, Massivit3D,

Freemelt, Xi’an BLT, Farsoon, Nano Dimensions, Zortrax and Nano

Dimensions. Larger publicly traded companies which offer 3D printing

systems and services include HP, Nikon SLM Solutions (now fully

integrated into Nikon), GE Additive, DMG Mori, Renishaw and others.